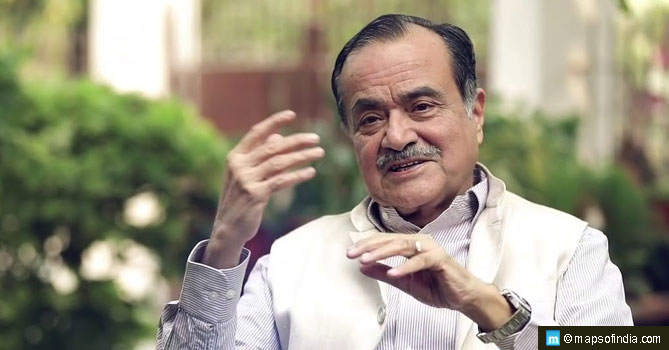

The former Managing Director of Maruti Suzuki India, Jagdish Khattar, has been booked by the Central Bureau of Investigation under allegations of a bank loan fraud of over a hundred crore rupees.

Khattar had joined Maruti Suzuki India Limited, as their Director of marketing in the year 1993. In six years, he rose to the post of their MD, having been nominated by the government as their official choice for the same. In 2002, he was re-elected for the post, this time as a Suzuki motor corporation nominee.

Post-retirement in 2007, he ventured into customising passenger segment cars in collaboration with DC design. A year later, his venture Carnation-Auto was launched, as a multi-brand automobile sales and service company. Here are brief actions with the timeline of the company.

– In 2009, Carnation Auto attempted a foray into the customisation of regular passenger cars, by collaborating with DC Design.

– In 2010, the company launched its very own web portal for the sale and purchase of used vehicles.

– In the year 2013, it saw the introduction of the country’s largest refurbished car showroom in the city of Noida.

During the first few years of its inception, Carnation Auto raised a combined seed funding of Rs. 108 crore from a pool of investors like PremjiInvest, IFCI ventures and Gaja Capital. This money was directed towards the nationwide expansion of the business through setups across all major cities in the country. The largest single sum investment into the project came from Punjab National Bank, an estimated one hundred and eighty crore rupees.

The last few years saw Carnation struggle to build a stronghold in the multi-brand automotive care and maintenance sector. However, market irregularities, along with many other reasons such as customer unpredictability and the unfavouring and non-cooperative demeanour of automotive manufacturers by their refusal to supply genuine spare-parts, caused it tremendous losses. This eventually led the company and its nationwide assets to be lined-up for being sold-off to recover some of the money that went into funding its execution.

The only business model in the country similar to that of Carnation has been Mahindra’s First choice service venture. The single successful organised multi-brand service network, MFC has almost eighteen hundred setups in over eight hundred cities across the country.

Some CBI officials have filed an FIR against Khattar and his company Carnation Auto India Limited for allegedly causing a loss of Rs. 110 crore to their major investor, Punjab National Bank. In 2015, the loan given to formers had been declared a non-performing asset according to this FIR.

The ex-MD and his company have been accused of the fraudulent sale and diversion of funds received from it, for assets which had been hypothecated to the bank, without its consent, causing an outright breach of financial trust. Besides, the bank also complained that the accused had consistently failed to deposit any funds and proceeds received from the resale of the said assets, with the bank.

In his defence, Khattar has also made a statement in which he has attempted to clarify the position he and his company have been put in. He described how his business had faced failure on account of numerous reasons, primarily among which was the lack of a steady spare-part supply. He said that from the very initial phase, Carnation had been an establishment with the best management practices and very clean functioning. The company was managed by a board of directors, which comprised of some of the most well-placed investors in the country, who kept an in-depth involvement in its operations and financial flow. All decisions and steps were based on elaborate planning and execution through a series of approvals.

Khattar also mentioned that upon its failure, the company was put through an independent forensic audit which was both exhausting and time-consuming. The audit was conducted upon a request of the bank and was carried out by a leading independent auditor whose conclusion established the absence of any financial anomalies. The bank then presented the matter to the Bureau as part of their elaborate recovery-attempt process.

He repetitively claimed that neither he nor the company has indulged in any unfair means or business practices and such was yet again proven by a subsequent search conducted by the Bureau. Khattar also stated that he had invested his life savings into the company and despite its failure, will not step aside and will assure his full cooperation with the authorities during any investigation. He seemed confident that like before, he and the concerned will once again be cleared in all audits upon completion of the newly-filed investigation.

In recent disclosure of information, Carnation Auto has been sold to Mahindra First Choice services along with its key assets such as their trademark, website, software licenses, workshop network and the branding rights to the company, formerly owned by Mr Khattar. The merger has been the first significant step towards the restructuring of the five-thousand crore Indian aftermarket.