How the Effective Tariffs Will Work

New tariffs are set to be reciprocal and adaptable. This means:

- Those countries that have more barriers to trade in their country for U.S. goods will attract increased duties.

- If a nation reduces its tariffs or restrictions on American products, the U.S. can lower its rate to that nation, showing up as an adjustment on the tariff map.

- The system serves as a tool for trade negotiations, where it can be adjusted according to the policies of each country.

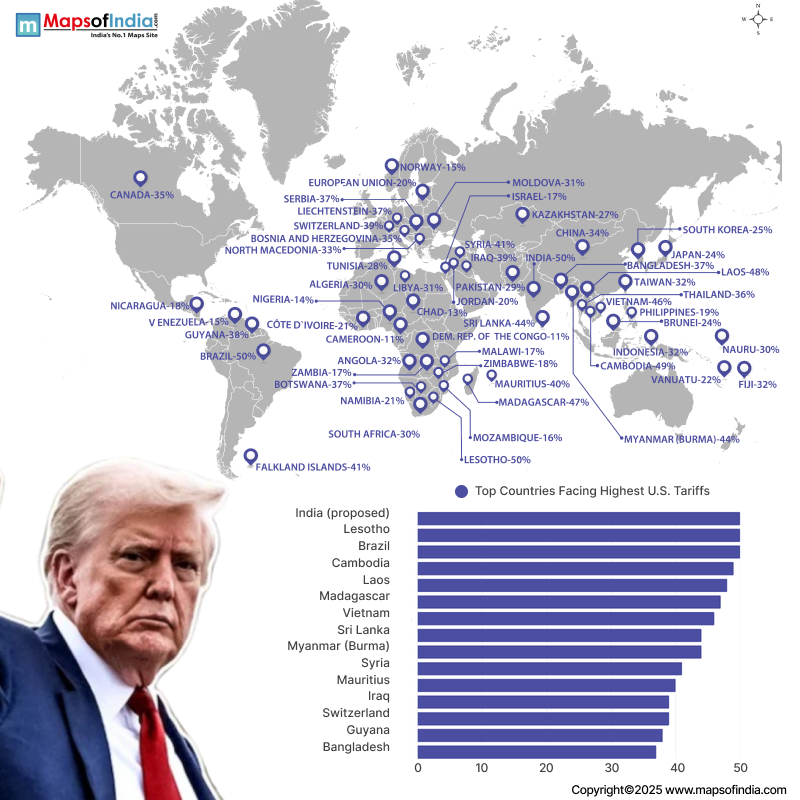

Country-Wise Tariff Rates

The table that follows is the reciprocal tariff rates according to the annex of the order:

| Country | Reciprocal Tariff, Adjusted |

| Afganistan | 15% |

| Algeria | 30% |

| Angola | 15% |

| Bangladesh | 20% |

| Bolivia | 15% |

| Bosnia and Herzegovina | 30% |

| Botswana | 15% |

| Brazil | 10% |

| Brunei | 25% |

| Cambodia | 19% |

| Cameroon | 15% |

| Canada | 35% |

| Chad | 15% |

| China | 34% |

| Costa Rica | 15% |

| Côte d`Ivoire | 15% |

| Democratic Republic of the Congo | 15% |

| Ecuador | 15% |

| Equatorial Guinea | 15% |

| European Union: Goods with Column 1 Duty Rate> 15% | 0% |

| European Union: Goods with Column 1 Duty Rate < 15% | 15% minus Column 1 Duty Rate |

| Falkland Islands | 10% |

| Fiji | 15% |

| Ghana | 15% |

| Guyana | 15% |

| Iceland | 15% |

| India | 25% |

| Indonesia | 19% |

| Iraq | 35% |

| Israel | 15% |

| Japan | 15% |

| Jordan | 15% |

| Kazakhstan | 25% |

| Laos | 40% |

| Lesotho | 15% |

| Libya | 30% |

| Liechtenstein | 15% |

| Madagascar | 15% |

| Malawi | 15% |

| Malaysia | 19% |

| Mauritius | 15% |

| Moldova | 25% |

| Mozambique | 15% |

| Myanmar (Burma) | 40% |

| Namibia | 15% |

| Nauru | 15% |

| New Zealand | 15% |

| Nicaragua | 18% |

| Nigeria | 15% |

| North Macedonia | 15% |

| Norway | 15% |

| Pakistan | 19% |

| Papua New Guinea | 15% |

| Philippines | 19% |

| Serbia | 35% |

| South Africa | 30% |

| South Korea | 15% |

| Sri Lanka | 20% |

| Switzerland | 39% |

| Syria | 41% |

| Taiwan | 20% |

| Thailand | 19% |

| Trinidad and Tobago | 15% |

| Tunisia | 25% |

| Turkey | 15% |

| Uganda | 15% |

| United Kingdom | 10% |

| Vanuatu | 15% |

| Venezuela | 15% |

| Vietnam | 20% |

| Zambia | 15% |

| Zimbabwe | 15% |

Exceptions and Transitional Provisions

The order provides exemptions and transitional provisions that comprise both shipment-based and sector-based reliefs:

-

Goods in Transit Before Deadline

- Goods to be loaded in cargo vessels or aircraft before August 7, 2025, and reach in the U.S. before October 5, 2025, can be docked with the old tariff.

-

Certain Countries

- Countries that still have a trade agreement in place or are already levying higher mutual rates might incur altered or no further charges. As an illustration, countries in the EU that are already beyond the 15 per cent duty mark will stop increasing.

-

Sector and Industry Exemptions (As per GTRI)

- Certain critical and strategic products will be exempt from the 50% tariffs on the following products (clearly marked in the tariff map):

- Pharmaceuticals: Drug products and essential drug inputs, as well as active pharmaceutical ingredients (APIs).

- Energy Products: Crude oil, manufactured fuels, natural gas, coal and electricity.

- Critical Minerals: Raw materials that are needed to make a variety of products, as well as those that the government uses in defence.

- Electronics & Semiconductors: tablets, smartphones, solid-state drives, as well as flat panel displays and computers.

- Certain critical and strategic products will be exempt from the 50% tariffs on the following products (clearly marked in the tariff map):

-

Anti-Circumvention Clause

- Re-routed or transshipped goods that are subjected to tariffs will be charged an extra 40 per cent duty, accompanied by fines.

- A list of suspect countries and facilities used in evasion will be released by the public every six months.

Summary

The new tariff regime shows there is a strong readiness of the U.S. to reciprocate that seeking to flag countries depending on their barriers. Exempting the goods and services whose availability is essential, such as medicines, energy supplies, critical minerals and advanced electronics, the administration is then in a position of safeguarding the consumer access to essential goods despite giving good terms aimed at curbing trade imbalances.

The adjustment period demands many importers, exporters and MNCs to adjust to the new rates quickly, as they come into effect August 7, 2025, with a very close attention being paid to the exceptions regime and the anti-evasion regulations that are highly strict.

Last Updated on: January 13, 2026