BharatBharat VarshaHindustan

India

AryavartaJambu Dweepa

Discovering the Wonder that is India

What is India and what is her identity? Is she as elusive to find as the insides of a seed? A mere country cannot assume the bewitching charms that hang on her slender wrists. So, how to encounter the real India?

Sit by the ruins, and see the inscriptions carved on the walls of caves, and listen. Listen to the seers and the folklorists, to the waters of the perennial rivers and the echoes from the immortal gigantic mountains. Look at the personifications of prayer carved out of marble or stone, and lie under a banyan tree, and listen - Listen to India.

Sit by the ruins, and see the inscriptions carved on the walls of caves, and listen. Listen to the seers and the folklorists, to the waters of the perennial rivers and the echoes from the immortal gigantic mountains. Look at the personifications of prayer carved out of marble or stone, and lie under a banyan tree, and listen - Listen to India.

India is the name given to the vast peninsula which the continent of Asia throws out to the south of the magnificent mountain ranges that stretch in a sword like curve across the southern border of Tibet. Shaped like an irregular quadrilateral, this large expanse of territory we call India, deserves the name of a subcontinent. Ancient Geographers referred to India as being "constituted with a four-fold conformation" (chatuh samasthana samsthitam), "on its South and West and East is the Great Ocean, the Himavat range stretches along its north like the string of a bow".

India is the name given to the vast peninsula which the continent of Asia throws out to the south of the magnificent mountain ranges that stretch in a sword like curve across the southern border of Tibet. Shaped like an irregular quadrilateral, this large expanse of territory we call India, deserves the name of a subcontinent. Ancient Geographers referred to India as being "constituted with a four-fold conformation" (chatuh samasthana samsthitam), "on its South and West and East is the Great Ocean, the Himavat range stretches along its north like the string of a bow".

The name Himavat in the above passage refers not only to the snow-capped ranges of the Himalayas but also to their less elevated offshoots - the Patkai, Lushai and Chittagong Hills in the east, and the Sulaiman and Kirthar ranges in the west. These go down to the Sea and separate India from the wooded valley of Irrawady, on the one hand, and the hilly tableland of Iran, on the other. The Himalayas standing tall in breathtaking splendour are radiant in myth and mystery. These, the youngest and tallest mountain ranges, feed the Ganga with never-ending streams of snow. The Himalayas are home to the people of Kashmir, Himachal Pradesh, Uttaranchal, Sikkim and Arunachal Pradesh.

Indians love these peaks because they are a part of every Indian's life. Indians revere the mountains, as they would, the father. Even today, when urban India is racing against time, in the caves of the snow-clad peaks, live hermits - seeking the divine. Not a surprise when you consider that even this century has seen some great philosophers like Ramana Maharishi, Swami Vivekananda, Ramakrishna Paramhansa and J. Krishnamurti.

What is India and what is her identity? Is she as elusive to find as the insides of a seed? A mere country cannot assume the bewitching charms that hang on her slender wrists. So, how to encounter the real India?

The name Himavat in the above passage refers not only to the snow-capped ranges of the Himalayas but also to their less elevated offshoots - the Patkai, Lushai and Chittagong Hills in the east, and the Sulaiman and Kirthar ranges in the west. These go down to the Sea and separate India from the wooded valley of Irrawady, on the one hand, and the hilly tableland of Iran, on the other. The Himalayas standing tall in breathtaking splendour are radiant in myth and mystery. These, the youngest and tallest mountain ranges, feed the Ganga with never-ending streams of snow. The Himalayas are home to the people of Kashmir, Himachal Pradesh, Uttaranchal, Sikkim and Arunachal Pradesh.

Indians love these peaks because they are a part of every Indian's life. Indians revere the mountains, as they would, the father. Even today, when urban India is racing against time, in the caves of the snow-clad peaks, live hermits - seeking the divine. Not a surprise when you consider that even this century has seen some great philosophers like Ramana Maharishi, Swami Vivekananda, Ramakrishna Paramhansa and J. Krishnamurti.

| Official Name | Bharat, also known as Republic of India | Major Religions | Hinduism, Islam, Christianity, Sikhism, Buddhism, Jainism, Judaism, Zoroastrianism | |

| Capital | New Delhi | Number of States and Union Territories | 28 States and 8 Union Territories | |

| Population | 1,210,569,573 (2011 Census) | Time Zone (IST) | GMT plus 5.30 hrs | |

| Area | 3,287,263 square kilometers | President | Ram Nath Kovind | |

| Geographical Location | Between latitudes 8° 4' and 37° 6' North and longitudes 68° 7' and 97° 25' East | Vice President | Venkaiah Naidu | |

| Prime Minister | Narendra Modi | National Emblem | An adaptation of the Lion Capital of Emperor Ashoka at Sarnath | |

| National Anthem | Jana Gana Mana | Official Languages | Hindi, English | |

| National Song | Vande Mataram |

More Facts About India...

CURRENCY

(INDIAN RUPEE)

AQUATIC ANIMAL

RIVER DOLPHIN

FLOWER

LOTUS

FRUIT

MANGO

TREE

BANYAN

BIRD

INDIAN PEACOCK

LAND ANIMAL

TIGER

RIVER

GANGA OR GANGES

History of India - Celebrating India's Invincible Spirit

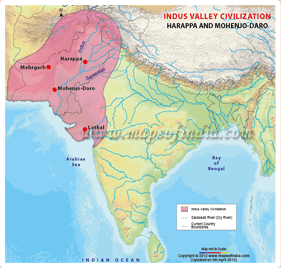

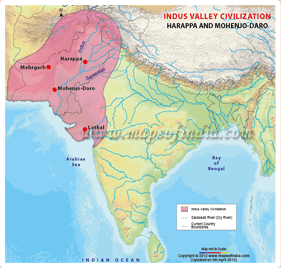

As the juggernaut of world history rolled on, many civilisations rose and fell and passed into oblivion but the spirit of India remains eternal and invincible, unscathed by the onslaught of Time. Indian history follows a continuous process of reinvention that can eventually prove elusive for those seeking to grasp its essential character. The history of this astonishing sub continent dates back to five thousand years ago, when the inhabitants of the Indus Valley Civilisation had developed an urban culture based on commerce and sustained by agricultural trade. Amongst the world's oldest, richest and most diverse cultures, India's unique ethos is rooted in its ethnic, cultural and religious diversity.

The political map of ancient and medieval India was made up of countless kingdoms with fluctuating boundaries that rendered the country vulnerable to foreign invasions. The Aryans were the first to invade the country. They came out of the North in about 1500 BC and brought with them strong cultural traditions. Persians, Greeks, Chinese nomads, Arabs, Portuguese, British and many others - the list of invaders who ruled India is long. Yet, none could crush the indomitable soul of Bharatvarsha!

Here is brief account of the History of India, which seeks to articulate the undying magic of the amazing nation that - in the words of American author Mark Twain - 'all men long to see, and having seen it once, would not give up that glimpse for all the wonders of the world'.

The political map of ancient and medieval India was made up of countless kingdoms with fluctuating boundaries that rendered the country vulnerable to foreign invasions. The Aryans were the first to invade the country. They came out of the North in about 1500 BC and brought with them strong cultural traditions. Persians, Greeks, Chinese nomads, Arabs, Portuguese, British and many others - the list of invaders who ruled India is long. Yet, none could crush the indomitable soul of Bharatvarsha!

Here is brief account of the History of India, which seeks to articulate the undying magic of the amazing nation that - in the words of American author Mark Twain - 'all men long to see, and having seen it once, would not give up that glimpse for all the wonders of the world'.

Ancient India

2500 BC

India's first major civilisation flourished around 2500 BC in the Indus river valley. This civilisation, which lasted for 1000 years, and is known as the Harappan culture, appears to have been the culmination of thousands of years of settlement. More...

.

1500 BC

From around 1500 BC onwards, Aryan tribes from Afghanistan and Central Asia began to filter into northwest India. Eventually these tribes were able to control the whole of Northern India, and many of the original inhabitants, the Dravidians, were pushed into south India.

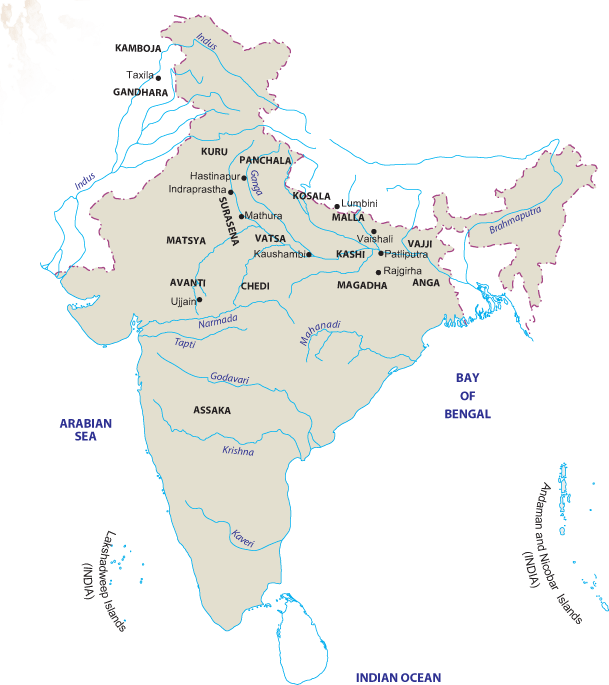

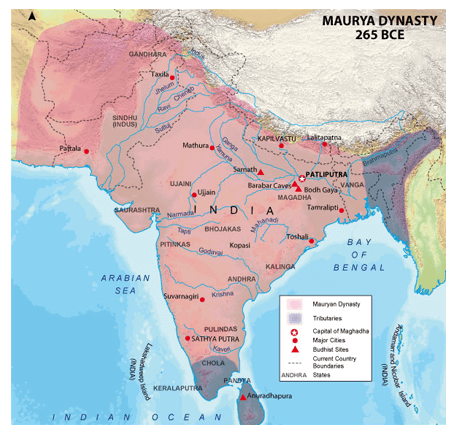

7th century BC

As the Aryan tribes spread out across the Ganges plain, in the seventh century BC, many of them were grouped together into 16 major kingdoms.

5th century BC

Gradually these amalgamated into four large states, with Kosala and Magadha emerging to be the most powerful during the fifth century BC.

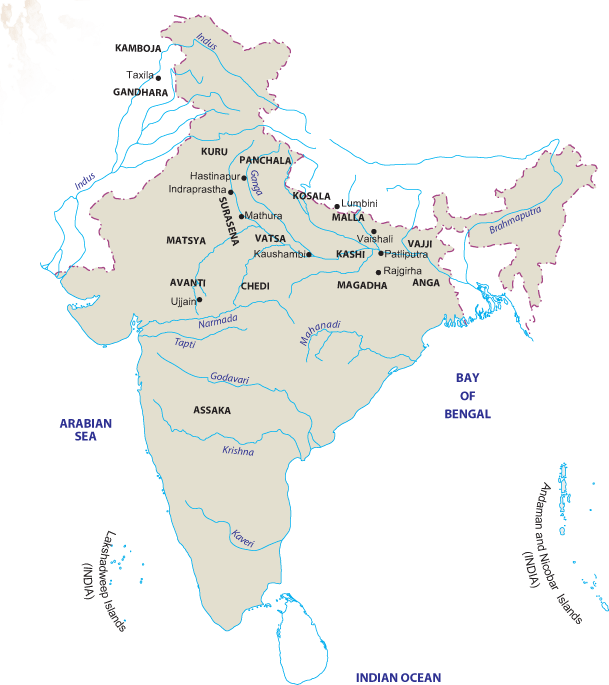

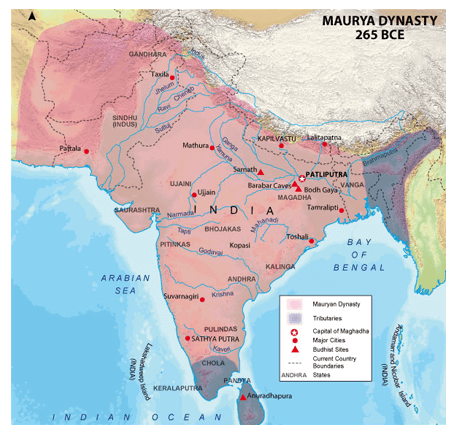

The Mauryas

The Mauryas were the first ruling dynasty to control large parts of North India and some parts of South India, as one territorial unit.

The Mauryas were the first ruling dynasty to control large parts of North India and some parts of South India, as one territorial unit.

Following the decline of the Mauryan Empire, a number of powerful kingdoms arose in central and south India, among them Satavahanas, Kalingas and Vakatakas hold precedence. Later on these regions saw the rise of some of the greatest dynasties of South India in the form of the Cholas, Pandyas, Cheras, Chalukyas and Pallavas. The next dynasty worth a mention is that of the Guptas. Although the Gupta Empire was not as large as the Maurya Empire, it kept North India politically united for more than a century from AD 335 to 455. More...

Following the decline of the Mauryan Empire, a number of powerful kingdoms arose in central and south India, among them Satavahanas, Kalingas and Vakatakas hold precedence. Later on these regions saw the rise of some of the greatest dynasties of South India in the form of the Cholas, Pandyas, Cheras, Chalukyas and Pallavas. The next dynasty worth a mention is that of the Guptas. Although the Gupta Empire was not as large as the Maurya Empire, it kept North India politically united for more than a century from AD 335 to 455. More...

Chandragupta Maurya

Founded by Chandragupta Maurya with the able guidance of Kautilya, the author of the famous treatise - Arthshastra -

Ashoka

the empire reached its peak under Ashoka. He left pillars and rock-carved edicts, which delineate the enormous span of his territory that covered large areas of the Indian subcontinent.

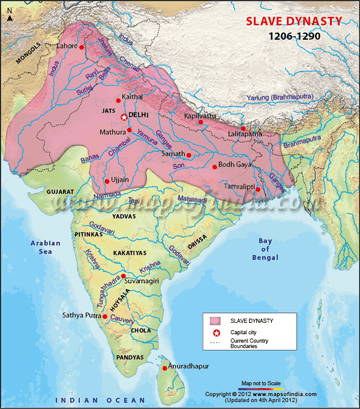

Medieval India

The decline of the Guptas in North India, and the consequent rise of a large but ineffective number of regional powers made the political situation very fluid and unstable by the ninth century AD. This paved the way for the Muslim invasion into India during the early half of the eleventh century.

These were felt in the form of 17 successive raids to North India, made by Mahmud of Ghazni between 1001 and 1025. These raids effectively shattered the balance of power in North India.

The next Muslim ruler to invade India Mohammad Ghauri attacked India and after some futile resistance by the local leadership he founded a foreign empire in India. Under him, large parts of India came under Muslim rule and very soon his successor Qutub-ud-din Aibak became the first of the sultans of Delhi.

His was followed by the rule of the Khaljis and Tughlaq, also known as the Delhi Sultanate, who ruled over a large portion of North India and parts of South India until the coming in of the Lodis and Sayyids. More...

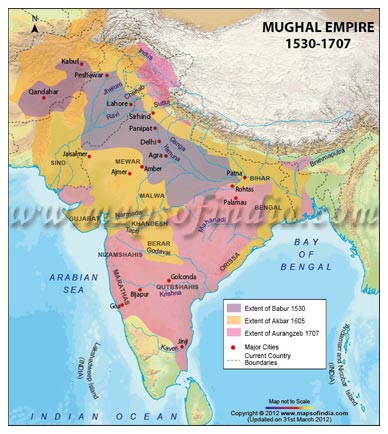

Mughal Period

Defeating Lodis and Sayyids, the Mughals established, what came to be known as the most vibrant era of Indian History.

The most prominent rulers of the Mughal dynasty

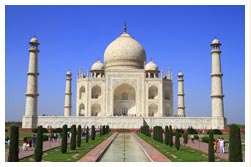

The Mughal Empire was massive, covering, at its height, almost the entire Indian subcontinent. The Mughal emperors presided over a golden age of arts and literature and had a passion for

buildings, which resulted in some of the greatest architecture in India, like the Taj Mahal at Agra. This apart, the large number of forts, palaces, gates, buildings, mosques, baolis (water tank or well) gardens, etc, forms the cultural heritage of the Mughals in India. The Mughals were also instrumental in establishing one of the most efficient administrative setups in India.

The decline of the Mughals saw the corresponding rise of Marathas in Western India. In other parts of India, however, a new trend of foreign invasion under the garb of commercial links had started from the 15th century AD onwards - first, with the arrival and gradual takeover of Goa by the Portuguese led by Vasco da Gama - between 1498 and 1510 AD; and then with the arrival, and the setting up of the first trading post at Surat, in Gujarat, by the East India Company.

The Danes and Dutch also had trading posts, and in 1672 AD, the French established themselves at Pondicherry, an enclave that they held even after the British had departed. More...

The decline of the Mughals saw the corresponding rise of Marathas in Western India. In other parts of India, however, a new trend of foreign invasion under the garb of commercial links had started from the 15th century AD onwards - first, with the arrival and gradual takeover of Goa by the Portuguese led by Vasco da Gama - between 1498 and 1510 AD; and then with the arrival, and the setting up of the first trading post at Surat, in Gujarat, by the East India Company.

The Danes and Dutch also had trading posts, and in 1672 AD, the French established themselves at Pondicherry, an enclave that they held even after the British had departed. More...

British India

The British represented by the East India Company established their commercial control over vast areas in India, which very soon had an administrative dimension to it. The British rule in India was, however, formalised by the direct takeover of India by the British Crown, after the First War of Independence in 1857.

History of the Raj is one of constant struggle between the nationalists - who assumed different names, ideologies, backgrounds and methods - and the British and their repressive policies.

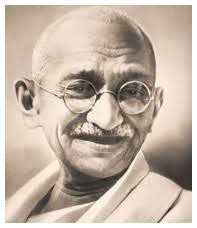

People from the length and breadth of India followed the path set by Mohandas Karamchand Gandhi, where truth and ahimsa or non-violence were held supreme. Strengthening this vision was the newly emerging intelligentsia. Raja Ram Mohan Roy, Bankim Chandra, Rabindranath Tagore, Subramanya Bharathi and Abul Kalam Azad were some of those who enthused people through their soul-stirring writings and songs to reach out to nationalism.

There were many who communicated directly with the masses. Bal Gangadhar Tilak, Asaf Ali, C. Rajagopalachari, Gopal Krishna Gokhale, Abdul Ghaffar Khan, Sardar Vallabhbhai Patel, Subhas Chandra Bose, Jawaharlal Nehru and Sarojini Naidu are some of the great names associated with the freedom struggle. More...

History of the Raj is one of constant struggle between the nationalists - who assumed different names, ideologies, backgrounds and methods - and the British and their repressive policies.

People from the length and breadth of India followed the path set by Mohandas Karamchand Gandhi, where truth and ahimsa or non-violence were held supreme. Strengthening this vision was the newly emerging intelligentsia. Raja Ram Mohan Roy, Bankim Chandra, Rabindranath Tagore, Subramanya Bharathi and Abul Kalam Azad were some of those who enthused people through their soul-stirring writings and songs to reach out to nationalism.

There were many who communicated directly with the masses. Bal Gangadhar Tilak, Asaf Ali, C. Rajagopalachari, Gopal Krishna Gokhale, Abdul Ghaffar Khan, Sardar Vallabhbhai Patel, Subhas Chandra Bose, Jawaharlal Nehru and Sarojini Naidu are some of the great names associated with the freedom struggle. More...

Jawaharlal Nehru became independent India's first Prime Minister and Rajendra Prasad the country's first President.

The Indian Constitution was drawn up in a matter of four years. It sought to assimilate different linguistic regions and religious communities of India into a cohesive Nation-State while, at the same time, conferring substantial autonomy upon the diverse states of the Indian Union.

India embarked upon planning and began to address the issues like land reforms, improvement of agricultural marketing techniques and irrigation facilities. Reducing dependency on the fickle monsoons was a major priority area since most of Indian agriculture is rain-fed.

All this required, in addition to planning, a good deal of research. Moving over to scientific research and development, India raised her agricultural production to a consistent growth rate of three percent per annum.

India after Independence

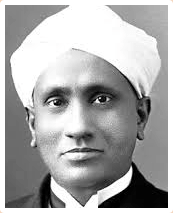

India started building a scientific foundation for all her programmes, whether it was agricultural research, pure scientific research or product designs for the craftsmen. If C. V. Raman, Subrahmanyan Chandrasekhar and Hargobind Khorana were recipients of the Nobel Prize, there were others with equal capabilities like Homi Bhabha, Shanti Swarup Bhatnagar, Jagdish Chandra Bose, Meghnad Saha Kothari, Krishnan, Vikram Sarabhai and Pal who concentrated their energies on creating the environment and infrastructure for further academic and developmental activities.

India started building a scientific foundation for all her programmes, whether it was agricultural research, pure scientific research or product designs for the craftsmen. If C. V. Raman, Subrahmanyan Chandrasekhar and Hargobind Khorana were recipients of the Nobel Prize, there were others with equal capabilities like Homi Bhabha, Shanti Swarup Bhatnagar, Jagdish Chandra Bose, Meghnad Saha Kothari, Krishnan, Vikram Sarabhai and Pal who concentrated their energies on creating the environment and infrastructure for further academic and developmental activities.

The 'Green Revolution' of the sixties and the 'White Revolution' of the seventies brought about amazing results in agriculture and cooperative dairy farming.

The 'Green Revolution' of the sixties and the 'White Revolution' of the seventies brought about amazing results in agriculture and cooperative dairy farming.

With the ninth-largest economy in the world by GDP and the third-largest by purchasing power parity (PPP), India is the second fastest growing economy in the world after China. From world class infrastructure, mega cities, economic hubs, modern airports, swanky multiplexes, thriving retail centres, plush hotels, to knowledge and information technology parks, the country has everything to illustrate its rapid strides on the fast trajectory of modernisation and holistic development.

Today, the country marches proudly as the second largest country in Asia and the seventh largest and second most populous country on Earth. India comprises as much as one third of Asia and supports one seventh of humanity. It has been recognised as the largest democracy of the world, and an emerging global power. More...

With the ninth-largest economy in the world by GDP and the third-largest by purchasing power parity (PPP), India is the second fastest growing economy in the world after China. From world class infrastructure, mega cities, economic hubs, modern airports, swanky multiplexes, thriving retail centres, plush hotels, to knowledge and information technology parks, the country has everything to illustrate its rapid strides on the fast trajectory of modernisation and holistic development.

Today, the country marches proudly as the second largest country in Asia and the seventh largest and second most populous country on Earth. India comprises as much as one third of Asia and supports one seventh of humanity. It has been recognised as the largest democracy of the world, and an emerging global power. More...

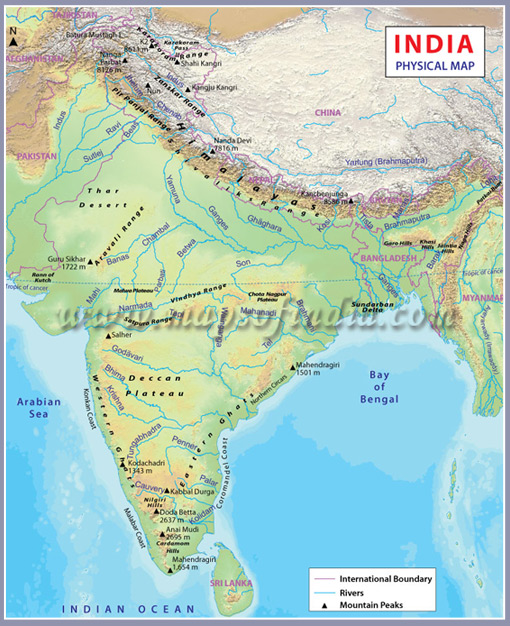

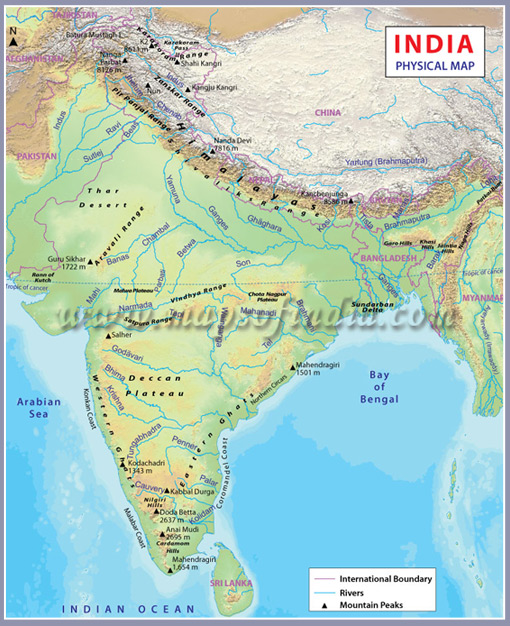

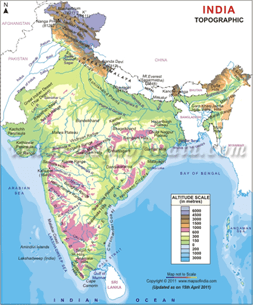

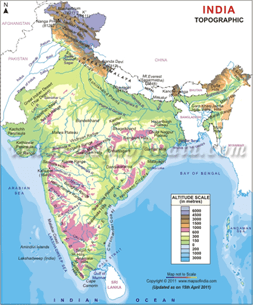

Geography : Location & Topography

India is also fortunate in possessing a wide stretch of fertile lands, made up of the alluvial soil brought down in the form of fine silt by the mighty rivers. Lying south of the Himalayas, these Great North Indian Plains consist of the Indus basin, Ganga-Brahmaputra basin, and the tributaries of these mighty river systems.

India is also fortunate in possessing a wide stretch of fertile lands, made up of the alluvial soil brought down in the form of fine silt by the mighty rivers. Lying south of the Himalayas, these Great North Indian Plains consist of the Indus basin, Ganga-Brahmaputra basin, and the tributaries of these mighty river systems.

To the south of the Great Plains of Northern India lies the Great Plateau of Peninsular India, which is divided into three parts, namely the Malwa Plateau, the Chota Nagpur Plateau and the Deccan Plateau. The Malwa plateau bounded by the Aravalli hills and the Vindhyas form the northern half of this peninsula. The valley of the Narmada River forms the Southern boundary of this plateau. Chota Nagpur Plateau lies in the Eastern part of the peninsular and is the richest minerals producing region of India. The Deccan Plateau extends from the Satpura hills in the north to Kanyakumari in South.

To the south of the Great Plains of Northern India lies the Great Plateau of Peninsular India, which is divided into three parts, namely the Malwa Plateau, the Chota Nagpur Plateau and the Deccan Plateau. The Malwa plateau bounded by the Aravalli hills and the Vindhyas form the northern half of this peninsula. The valley of the Narmada River forms the Southern boundary of this plateau. Chota Nagpur Plateau lies in the Eastern part of the peninsular and is the richest minerals producing region of India. The Deccan Plateau extends from the Satpura hills in the north to Kanyakumari in South.

Towards the west of the Deccan Plateau lie the Western Ghats that comprise of the Sahyadri, the Nilgiri, the Annamalai and the Cardamom Hills. On the eastern side, this plateau merges into a layer of discontinuous low hills known as the Mahendra Giri hills, which comprise of the Eastern Ghats.

Narrow coastal plains along the Arabian Sea and the Bay of Bengal flank the Deccan Plateau on its eastern and western sides, respectively. The Western coastal plains lying between the Western Ghats and the Arabian Sea, further split into the Northern Konkan Coast and the Southern Malabar Coast. The Eastern coastal plains, on the other hand lie between the Eastern Ghats and the Bay of Bengal and like the Western plains are divided into two parts - the Coromandel Coast as the Southern part and the Northern Circars as the Northern part.

Narrow coastal plains along the Arabian Sea and the Bay of Bengal flank the Deccan Plateau on its eastern and western sides, respectively. The Western coastal plains lying between the Western Ghats and the Arabian Sea, further split into the Northern Konkan Coast and the Southern Malabar Coast. The Eastern coastal plains, on the other hand lie between the Eastern Ghats and the Bay of Bengal and like the Western plains are divided into two parts - the Coromandel Coast as the Southern part and the Northern Circars as the Northern part.

Towards the Western half of India lies a vast stretch of land that is divided by the Aravalli Mountains into two separate units. The area to the west of the Aravalli comprises of the Thar Desert - made up of sand and interrupted by rocky hills and waterless valleys. This arid land extends deep into Pakistan. The state of Gujarat lies to the east of this range and is one of the most prosperous regions in India.

Towards the Western half of India lies a vast stretch of land that is divided by the Aravalli Mountains into two separate units. The area to the west of the Aravalli comprises of the Thar Desert - made up of sand and interrupted by rocky hills and waterless valleys. This arid land extends deep into Pakistan. The state of Gujarat lies to the east of this range and is one of the most prosperous regions in India.

Located in the Southern part of Asia, India lies between 8°4' and 37°6' N Latitude and 68°7' and 97°25' E Longitude. This seventh largest country in the world spreads over an area of 3,166,414 sq. km., including Lakshadweep Island in the Arabian Sea and the Andaman and Nicobar Islands in the Bay of Bengal. India is bounded by the Arabian Sea on its west and south west and the Bay of Bengal on its east and south east and the Himalayan Mountain ranges borders the country on its north. India shares its territorial border with Afghanistan, Pakistan, China, Nepal, Bhutan and Bangladesh.

India is blessed with diverse topography—from mountains to plains, to plateaus, deserts, coasts and islands. The Tropic of Cancer divides the country into two equal parts in the Northern and Southern part, and the Vindhya Mountains cut right across the country, from West to East.

The Himalayas, which forms the Northern boundary of the country, consist of three parallel series of mountain range: the Himadri, Himachal and Shivaliks.

India is blessed with diverse topography—from mountains to plains, to plateaus, deserts, coasts and islands. The Tropic of Cancer divides the country into two equal parts in the Northern and Southern part, and the Vindhya Mountains cut right across the country, from West to East.

The Himalayas, which forms the Northern boundary of the country, consist of three parallel series of mountain range: the Himadri, Himachal and Shivaliks.

Towards the west of the Deccan Plateau lie the Western Ghats that comprise of the Sahyadri, the Nilgiri, the Annamalai and the Cardamom Hills. On the eastern side, this plateau merges into a layer of discontinuous low hills known as the Mahendra Giri hills, which comprise of the Eastern Ghats.

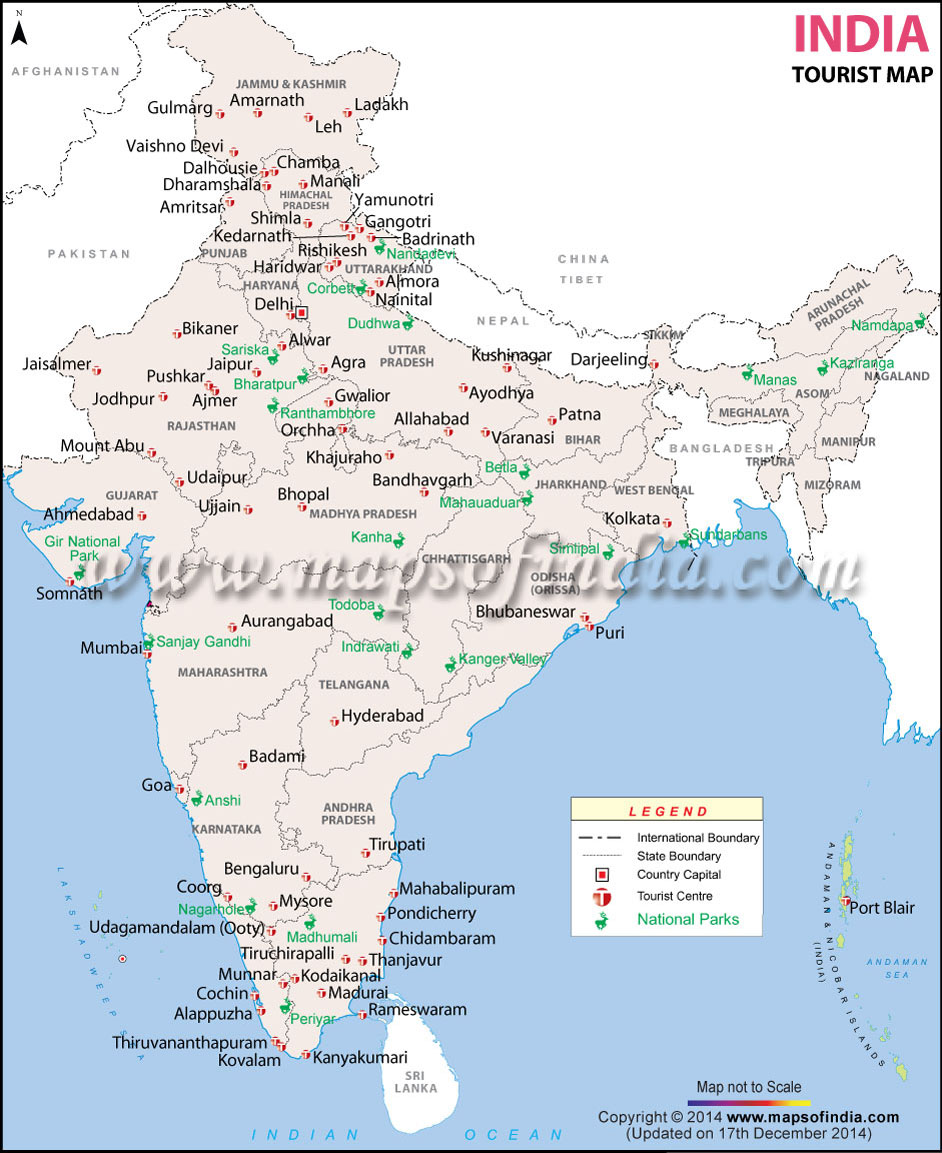

India Maps

India is a vast country in the Southern portion of Asia which is bound by Indian Ocean on its south, Arabian Sea on its west and Bay of Bengal on its east and borders Pakistan, Nepal, Bhutan, China and Bangladesh on its north, northwest, northeast and east. Physical India maps can serve as effective tools for understanding the geophysical and topological features of the Indian sub-continent. An India outline map clearly defines the geopolitical outline of the country and India political map can help better understand the political boundaries and sub-divisions of the country for all practical purposes. In the physical map of India, earthquake prone regions (high risk) can be located as Himalayan region, parts of North Indian plains and parts of Gujarat. India has also witnessed some of the devastating earthquakes in these regions. India is an immense country with more than a billion population. India road map is an excellent tool for understanding the Indian transportation network, which includes an immense road network, covering almost whole of the sub-continent. However, Indian rail network and air travel network have emerged as virtual engines of economic growth in the modern times even while falling behind the road network in terms of geographical reach.

India is a vast country in the Southern portion of Asia which is bound by Indian Ocean on its south, Arabian Sea on its west and Bay of Bengal on its east and borders Pakistan, Nepal, Bhutan, China and Bangladesh on its north, northwest, northeast and east. Physical India maps can serve as effective tools for understanding the geophysical and topological features of the Indian sub-continent. An India outline map clearly defines the geopolitical outline of the country and India political map can help better understand the political boundaries and sub-divisions of the country for all practical purposes. In the physical map of India, earthquake prone regions (high risk) can be located as Himalayan region, parts of North Indian plains and parts of Gujarat. India has also witnessed some of the devastating earthquakes in these regions. India is an immense country with more than a billion population. India road map is an excellent tool for understanding the Indian transportation network, which includes an immense road network, covering almost whole of the sub-continent. However, Indian rail network and air travel network have emerged as virtual engines of economic growth in the modern times even while falling behind the road network in terms of geographical reach.

Culture of India

India, known for unity in diversity, offers an awesome, creative burst of culture - a potpourri of religions, races and languages. The roots of Indian culture and civilization can be traced back to more than 5,000 years ago with an unbroken continuity of traditions, customs and world-renowned schools of philosophy. Amongst the world's oldest, richest and most diverse cultures, India represents an amazing confluence of different creeds, religions, faiths and belief systems, further divided among castes, sects and sub-sects.

For times immemorial, India has remained a meeting ground between the East and the West, a treasure house of knowledge and wisdom. The Vedic culture and Vedic way of life have struck deep roots in India and are followed by people even today. Apart from the Vedas, other important scriptures composed during Vedic times include the Upanishadas (enlightening commentaries on the Vedas), the shrutis and the smritis (storehouses of heard and remembered erudition and learning).

India believes in Sarva dharma samabhava, which means respect for all belief systems. This has allowed not just tolerance towards religions and beliefs, but the freedom to propound one's ideas and philosophies.

After assimilating and nurturing an incredible diversity of people and cultures for millennia, India culture remains an object of fascination for people the world over. The objects of ethnic interest like unique Indian dresses, delectable Indian food recipes, sonorous Indian music and exotic Indian names evoke global interest on a continuous basis. More...

After assimilating and nurturing an incredible diversity of people and cultures for millennia, India culture remains an object of fascination for people the world over. The objects of ethnic interest like unique Indian dresses, delectable Indian food recipes, sonorous Indian music and exotic Indian names evoke global interest on a continuous basis. More...

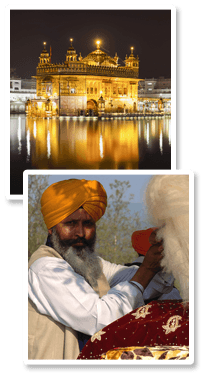

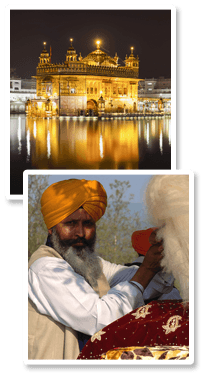

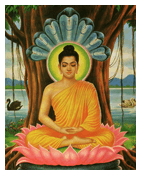

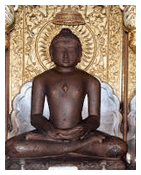

Religion In India, religion is not simply a belief system but a journey of self exploration. All the major religions of the world like Hinduism, Sikhism, Buddhism, Jainism, Islam and Christianity including their sects, are found and practised in India with complete freedom.

Religions have co-existed and evolved together for many centuries in the country and are very central to the lives of the people, who have a remarkable openness to even foreign religions. Judaism was one of the first foreign religions to arrive in India about 2500 years ago;

For times immemorial, India has remained a meeting ground between the East and the West, a treasure house of knowledge and wisdom. The Vedic culture and Vedic way of life have struck deep roots in India and are followed by people even today. Apart from the Vedas, other important scriptures composed during Vedic times include the Upanishadas (enlightening commentaries on the Vedas), the shrutis and the smritis (storehouses of heard and remembered erudition and learning).

India believes in Sarva dharma samabhava, which means respect for all belief systems. This has allowed not just tolerance towards religions and beliefs, but the freedom to propound one's ideas and philosophies.

Religion In India, religion is not simply a belief system but a journey of self exploration. All the major religions of the world like Hinduism, Sikhism, Buddhism, Jainism, Islam and Christianity including their sects, are found and practised in India with complete freedom.

Religions have co-existed and evolved together for many centuries in the country and are very central to the lives of the people, who have a remarkable openness to even foreign religions. Judaism was one of the first foreign religions to arrive in India about 2500 years ago;

Islam was spread across over a period of 700 years

Zoroastrianism arrived from Iran during the 8th or 10th century while the colonial rule introduced the country to Christianity.Lord Buddha was born in India and it is from the shores of this land that Buddhism was disseminated to Sri Lanka and to Tibet.As the gods and goddesses in their myriad forms were worshipped with elaborate rituals in the country, there appeared in the 15 century a reformer who enjoined a simpler form of worship, shorn of rituals. He was Guru Nanak Dev, whose teachings and those of the nine gurus who followed later are collected in the holy book of the Sikhs, the Guru Granth Sahib.

Christians are equally at home in India. Christian saints came to India many centuries ago and preached the doctrine of Christianity. It is believed that St Thomas, one of the twelve apostles of Christ, came to India in the first century AD, and spent the rest of his life in India preaching. His tomb, St Thomas Mount in Chennai, Tamil Nadu has become a place of pilgrimage for Christians in India. The Spanish Catholic missionary, St Francis Xavier, also spent the greater part of his life in Goa. His body, in a glass casket, has been kept in the Basilica of Bom Jesus in Panjim, Goa. Every ten years, his relics are exposed to the public, and people from all over the world throng Goa to receive the benediction. More...

Festivals

The tradition of celebrating festivals goes back to the Vedic period. The scriptures and works of literature of this era are replete with references to festivals. These were the celebrations in honour of gods, rivers, trees, mountains, and seasons like spring, and monsoon. These were the times for prayers and meditation, and also for spectacle and procession - occasions to express pure joy with performances comprising music, dance and drama, and conducting fairs.

The Constitution of India has guaranteed the freedom of worship and way of life to all its citizens. This has ensured the rich kaleidoscope of festivals that are celebrated throughout the country. More...

The festival of Eid is celebrated at the end of a month-long fasting. Christmas, commemoration of the birth of Jesus Christ, transcends the barriers of faith to become an occasion for celebration of joy across the country.

The festival of Eid is celebrated at the end of a month-long fasting. Christmas, commemoration of the birth of Jesus Christ, transcends the barriers of faith to become an occasion for celebration of joy across the country.

There are also numerous glittering fairs held in the country. The gem in the crown is, of course, the Kumbha Mela held at Haridwar, Prayag (Allahabad), Nashik and Ujjain. Pushkar Fair and Urs at Ajmer are some other famous examples. So are the Nauchandi mela, held on the second Sunday after Holi in Meerut; and Sonepur Cattle Fair - Asia's biggest cattle fair, held on Kartik Poornima in Bihar's Sonepur, on the confluence of river Ganges and Gandak.

The Constitution of India has guaranteed the freedom of worship and way of life to all its citizens. This has ensured the rich kaleidoscope of festivals that are celebrated throughout the country. More...

Diwali

The most colourful of all the festival is Deepawali or Diwali, the festival of lights. Rama, the central figure in the epic Ramayana, went into exile for 14 years, accompanied by his wife Sita and brother Lakshman. During their wanderings in the forests, Ravana, the king of Lanka, carried Sita away. It was only after an epic battle that Rama vanquished Ravana, rescued Sita and returned home. The journey from Lanka in the south to Ayodhya in the north took 20 days. His triumphal return brought great joy to his people who illuminated the whole city to celebrate the occasion. This tradition continues to this day as houses and cities throughout India are lit up every year (traditionally with small earthenware cups or diyas filled with oil) to commemorate the anniversary. Deepawali signifies the triumph of good over evil and light over darkness. More...

Dussehra

The battle between Ravana and Rama and the latter's victory are celebrated as Dussehra in many parts of India, 20 days before Deepawali. Dussehra is the day when the effigies of Ravana, his brothers Meghnath and Kumbhakaran, are burnt.

It is preceded by enactment of the story of the Ramayana by amateur groups of people in what is known as Ram Lila where all-night performances of the Ramayana from the beginning to the end are enacted; the actors are mainly young boys who perform the role of male as well as female characters. More...

It is preceded by enactment of the story of the Ramayana by amateur groups of people in what is known as Ram Lila where all-night performances of the Ramayana from the beginning to the end are enacted; the actors are mainly young boys who perform the role of male as well as female characters. More...

Durga Pooja and Ganesh Chaturthi

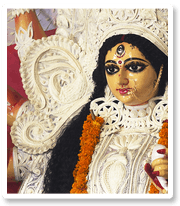

In Bengal, the worship of the Goddess Durga precedes Deepawali. While Goddess Durga is worshipped with great devotion in West Bengal,

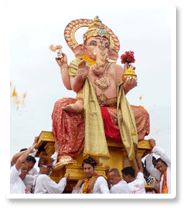

Lord Ganesha - acknowledged as the remover of obstacles - is the central figure in the celebration of Ganesh Chaturthi in Maharashtra. characters.

Lord Ganesha - acknowledged as the remover of obstacles - is the central figure in the celebration of Ganesh Chaturthi in Maharashtra. characters.

Janmashtami

Lord Krishna, the eighth incarnation of Vishnu, is the divine core in the epic Mahabharata. It was he who gave the sermon of the Bhagwat Gita (the song Celestial) to Arjuna, one of the five Pandava brothers during their battle with the Kauravas at Kurukshetra. This battle again epitomises the fight between the forces of evil and good. Lord Krishna is venerated all over India and there are temples dedicated to him specifically but in particular, his home ground of Vrindavan and Mathura where he lived as a boy and revealed his divinity by the miracles he wrought.More...

Guru Nanak Jayanti and Baisakhi

The birth anniversaries of Guru Nanak and Guru Gobind Singh, the tenth and last of Gurus, are very important days and are celebrated with religious fervour and devotion. Processions are taken out, the scriptures are chanted, without a break, and the Gurudwaras (Sikh temples) are illuminated.

The Indian calendar, as opposed to the Gregorian, starts in April. New Year's Day is April 13, celebrated as Baisakhi, which coincides with the harvesting of the wheat crop in Northern India, especially in Punjab. People wear new clothes, sing and dance in joy. In Eastern India, the New Year begins on April 14 and again it is a joyous occasion with singing and dancing by young men and women who don their best silken mekhalas (sarongs) and chaddars (an overwrap) and dance to the beat of the drum. This festival is known as Rangali Bihu in Assam.

The Indian calendar, as opposed to the Gregorian, starts in April. New Year's Day is April 13, celebrated as Baisakhi, which coincides with the harvesting of the wheat crop in Northern India, especially in Punjab. People wear new clothes, sing and dance in joy. In Eastern India, the New Year begins on April 14 and again it is a joyous occasion with singing and dancing by young men and women who don their best silken mekhalas (sarongs) and chaddars (an overwrap) and dance to the beat of the drum. This festival is known as Rangali Bihu in Assam.

Holi

Then there is Holi, the festivals of colours when men, women and children drench one another with coloured water to celebrate the beauty of spring season, when flowers bloom and deck the earth. More...

There are also numerous glittering fairs held in the country. The gem in the crown is, of course, the Kumbha Mela held at Haridwar, Prayag (Allahabad), Nashik and Ujjain. Pushkar Fair and Urs at Ajmer are some other famous examples. So are the Nauchandi mela, held on the second Sunday after Holi in Meerut; and Sonepur Cattle Fair - Asia's biggest cattle fair, held on Kartik Poornima in Bihar's Sonepur, on the confluence of river Ganges and Gandak.

Languages

Throughout history, Indian languages and literature have exercised a great deal of influence on other great civilizations and intellectual development of the world at large. To know the real India, languages of different regions must be acquainted with, which can afford a great deal of information on India culture, traditions, history and folklore.

Although Hindi and English are the major languages in India, there are 22 official languages and countless other dialects. Apart from producing numerous masterpieces of literature, India has taken rapid strides for promoting all branches of education. Right from ancient times, India has enjoyed the unquestioned reputation of being the centre of excellence in education.

Although Hindi and English are the major languages in India, there are 22 official languages and countless other dialects. Apart from producing numerous masterpieces of literature, India has taken rapid strides for promoting all branches of education. Right from ancient times, India has enjoyed the unquestioned reputation of being the centre of excellence in education.

In the past, the Takshila University flourished in the northwest and Nalanda University in the east of India. The tradition of quality education is carried forward by modern Indian universities such as Delhi University (DU), Jawaharlal Nehru University (JNU), Banaras Hindu University (BHU), Aligarh Muslim University (AMU) Jamia Millia University, Allahabad University, Visva-Bharati University and Vanasthali Vidya Peeth, to name a few. More...

Spiritual India The spirit of India has fascinated the world with its very mystique. Spiritual India, rich in holy places, traditions and beliefs, offers much for those seeking knowledge and awareness of the inner world.

Indians engage themselves in spiritual pursuits to strike a balance between the needs of the body and of the soul. India has always been a votary of peace and non-violence as exemplified by the teachings of Buddha, Mahavira, Guru Nanak of Mahatma Gandhi in the recent past.

Indians engage themselves in spiritual pursuits to strike a balance between the needs of the body and of the soul. India has always been a votary of peace and non-violence as exemplified by the teachings of Buddha, Mahavira, Guru Nanak of Mahatma Gandhi in the recent past.

In India, spirituality is part of everyday life. While religion is more about rituals, spirituality is more to do with one's self, or the spirit. To understand Indian spirituality, it is essential to understand the basic tenets of Hinduism.

A rich, complex and deeply symbolic religion, Hinduism is called Sanatana Dharma or the eternal truth, tradition or religion. It is the world's oldest religion or rather a way of life.

Arts (Handicrafts, Paintings, Music, Dances, Cuisine, Films) The birthplace of great epics – Mahabharata and Ramayana – India has a veritable wealth of literature including the fascinating stories of the Panchtantra; Raghuvamsha, Shakuntala, Meghaduuta, written by Kālidāsa; Pāṇini's Ashtadhyayi which standardised the grammar and phonetics of Classical Sanskrit; Chanakya's Arthashastra ( a treatise on statecraft, economic policy and military strategy) and Vatsyayana's magnum opus on the art of love-making - Kamasutra.; Geeta Govinda by Jayadeva and the famous Akbar-Birbal stories.

Lord Krishna love for Radha has been the inspiration for miniature painters of the Kangra or Pahari school of Painting, as also for the elaborate style of painting embellished with gold, known as the Tanjore styles from South India.

Lord Krishna love for Radha has been the inspiration for miniature painters of the Kangra or Pahari school of Painting, as also for the elaborate style of painting embellished with gold, known as the Tanjore styles from South India.

In ancient India, kitchen was considered like a place of worship where the fire God resided and nourished the whole family. The exotic Indian cuisine has never failed to attract natives as well as foreigners, perhaps for the reason that India has an unending variety of Indian recipes known for their unique flavour.

Contrary to the popular perception, in traditional India, girls were placed under the guidance of learned Gurus, where, along with various s, they were also made to learn and practise varied forms of Indian music and dance to develop their artistic skills. Especially after marriage, Indian women were supposed to wear intricate Indian jewellery, which is considered an auspicious symbol for their marital happiness.

Before Independence, many village crafts languished as the British implemented the policy of lop-sided industrialisation. Post-Independence, there is a definite revival in general of traditions and of craft traditions, in particular. Crafts are an intrinsic part of the religious and ritual traditions as craftsmen often worked for the temples and for providing the appurtenances necessary for worship.

In the modern context, India occupies a special place as the home to Bollywood, one of the largest film industries around the world which represents a unique cultural identity of the nation. Indian movies have been making waves across the world, besides doing well within the country. An expansion of commercial cinema and a number of cross-over Indian movies have created a global craze for Indian actors and superstars. The emergence of a whole new generation of Indian models in the India fashion industry has also made a great impact on the global media. Indian talents have showcased their potential by winning a number of international beauty pageants.

In the past, the Takshila University flourished in the northwest and Nalanda University in the east of India. The tradition of quality education is carried forward by modern Indian universities such as Delhi University (DU), Jawaharlal Nehru University (JNU), Banaras Hindu University (BHU), Aligarh Muslim University (AMU) Jamia Millia University, Allahabad University, Visva-Bharati University and Vanasthali Vidya Peeth, to name a few. More...

Spiritual India The spirit of India has fascinated the world with its very mystique. Spiritual India, rich in holy places, traditions and beliefs, offers much for those seeking knowledge and awareness of the inner world.

In India, spirituality is part of everyday life. While religion is more about rituals, spirituality is more to do with one's self, or the spirit. To understand Indian spirituality, it is essential to understand the basic tenets of Hinduism.

A rich, complex and deeply symbolic religion, Hinduism is called Sanatana Dharma or the eternal truth, tradition or religion. It is the world's oldest religion or rather a way of life.

Arts (Handicrafts, Paintings, Music, Dances, Cuisine, Films) The birthplace of great epics – Mahabharata and Ramayana – India has a veritable wealth of literature including the fascinating stories of the Panchtantra; Raghuvamsha, Shakuntala, Meghaduuta, written by Kālidāsa; Pāṇini's Ashtadhyayi which standardised the grammar and phonetics of Classical Sanskrit; Chanakya's Arthashastra ( a treatise on statecraft, economic policy and military strategy) and Vatsyayana's magnum opus on the art of love-making - Kamasutra.; Geeta Govinda by Jayadeva and the famous Akbar-Birbal stories.

In ancient India, kitchen was considered like a place of worship where the fire God resided and nourished the whole family. The exotic Indian cuisine has never failed to attract natives as well as foreigners, perhaps for the reason that India has an unending variety of Indian recipes known for their unique flavour.

Contrary to the popular perception, in traditional India, girls were placed under the guidance of learned Gurus, where, along with various s, they were also made to learn and practise varied forms of Indian music and dance to develop their artistic skills. Especially after marriage, Indian women were supposed to wear intricate Indian jewellery, which is considered an auspicious symbol for their marital happiness.

Before Independence, many village crafts languished as the British implemented the policy of lop-sided industrialisation. Post-Independence, there is a definite revival in general of traditions and of craft traditions, in particular. Crafts are an intrinsic part of the religious and ritual traditions as craftsmen often worked for the temples and for providing the appurtenances necessary for worship.

In the modern context, India occupies a special place as the home to Bollywood, one of the largest film industries around the world which represents a unique cultural identity of the nation. Indian movies have been making waves across the world, besides doing well within the country. An expansion of commercial cinema and a number of cross-over Indian movies have created a global craze for Indian actors and superstars. The emergence of a whole new generation of Indian models in the India fashion industry has also made a great impact on the global media. Indian talents have showcased their potential by winning a number of international beauty pageants.

Governance

India, the world's largest democracy, has made tremendous strides in economic and social development in the past two decades. The country aims to become a higher middle-income country by 2025 and that calls for even faster growth in the years to come. With new government in place this year, India currently stands at the threshold of a unique opportunity regarding governance reforms.

Governance is central to equitable socio-economic progress and political legitimacy. Good governance runs on four wheels: a representative and accountable government; a political system that derives legitimacy from participatory democracy; durable and solid institutions and equitable socio-economic growth.

Governance is central to equitable socio-economic progress and political legitimacy. Good governance runs on four wheels: a representative and accountable government; a political system that derives legitimacy from participatory democracy; durable and solid institutions and equitable socio-economic growth.

Governance in India has always been a critical issue for the governments since independence. Neither the soviet style socialist path nor the free-market western capitalist economy appeared the best answer for the country. It strives to craft a unique blend of its own socio-economic policies that would leverage its unique strengths and catapult it to centre-stage of the global economy. In order to achieve this goal, Prime Minister Narenda Modi has given the slogan,

“minimum government, maximum governance.”

Government service delivery system in India remains chaotic and a lot needs to be done in this regard. Government machineries at all level need to be strengthened. But mindset is changing as the government at the Centre has made it clear not only to its own wings but even to States that this chaos has to go with better use of information and communication technology. Some of the organisations have successfully transformed their way of functioning and service delivery system with the help of modern technology.

The quality and effectiveness of service delivery today is directly linked to good governance practices and use of modern technology, especially ICT. It is widely accepted that governance should be citizen-centric and we need alertness and responsiveness in every aspect of governance. Modern technology is increasingly in demand at the government departments and organisations across the country, either due to the increasing pressure from the public or on the initiatives of bureaucrats and elected representatives.

Corruption and sustainable economic development are key problems in India. But, as a vibrant democracy, India has a distinct advantage as it has an accountable government that is subject to transparent surveillance on multiple fronts, democratically elected legislatures, an independent judiciary and evolving regulatory watchdogs. That is India's inherent strength. The Right to Information Bill was passed in 2005 in an effort to improve governance and public administration and eliminate corruption. This Act widely known as ‘RTI' accords all citizens greater access to public documents than was earlier possible. Further, corruption investigations have increased significantly in many states and generally, there is fear among ‘corrupt' and ‘powerful' with regard to law.

Governance in India has always been a critical issue for the governments since independence. Neither the soviet style socialist path nor the free-market western capitalist economy appeared the best answer for the country. It strives to craft a unique blend of its own socio-economic policies that would leverage its unique strengths and catapult it to centre-stage of the global economy. In order to achieve this goal, Prime Minister Narenda Modi has given the slogan,

“minimum government, maximum governance.”

Government service delivery system in India remains chaotic and a lot needs to be done in this regard. Government machineries at all level need to be strengthened. But mindset is changing as the government at the Centre has made it clear not only to its own wings but even to States that this chaos has to go with better use of information and communication technology. Some of the organisations have successfully transformed their way of functioning and service delivery system with the help of modern technology.

The quality and effectiveness of service delivery today is directly linked to good governance practices and use of modern technology, especially ICT. It is widely accepted that governance should be citizen-centric and we need alertness and responsiveness in every aspect of governance. Modern technology is increasingly in demand at the government departments and organisations across the country, either due to the increasing pressure from the public or on the initiatives of bureaucrats and elected representatives.

Corruption and sustainable economic development are key problems in India. But, as a vibrant democracy, India has a distinct advantage as it has an accountable government that is subject to transparent surveillance on multiple fronts, democratically elected legislatures, an independent judiciary and evolving regulatory watchdogs. That is India's inherent strength. The Right to Information Bill was passed in 2005 in an effort to improve governance and public administration and eliminate corruption. This Act widely known as ‘RTI' accords all citizens greater access to public documents than was earlier possible. Further, corruption investigations have increased significantly in many states and generally, there is fear among ‘corrupt' and ‘powerful' with regard to law.

Devolution of power aimed at better governance

With amendments in Constitutions through the 73rd and 74th Amendments, powers were transferred to Panchayati Raj Institutions (PRIs) and Local Bodies. By transferring functions, fund and functionaries (3Fs), efforts are being made to transform the lives of people. Increased financial autonomy was supposed to be the game changer but we are still far behind from our cherished goals. Administration at various levels is still weak and the poor still suffer the most. Accountability, access to information, political will for real devolution of powers at all levels would only make the desired change and would lead to good governance.

Prime Minister Narendra Modi says, "one of the biggest benefits of good governance is that it does not look at welfare of any particular section of the people; it results in welfare of all. For example, if you improve water supply, everyone benefits.”

Prime Minister Narendra Modi says, "one of the biggest benefits of good governance is that it does not look at welfare of any particular section of the people; it results in welfare of all. For example, if you improve water supply, everyone benefits.”

Modi government has thus adopted the mantra of inclusive development – 'Sabka Saath Sabka Vikas'

E-governance has a major role to play in the efforts to establish good governance. Technology and innovation are the backbone of governance. Technology also plays a large role in creating and maintaining transparency.

Reducing public expenditure is yet another critical area. The government spends huge amount wages, pensions, interest payments, and agricultural subsidies and social sector schemes. Good governance calls for drastic reduction in wasteful public expenditure. Rational and inclusive growth oriented expenditure would lead us to a higher stage of advancement.

A long-established legal system has given India the underpinnings necessary for free enterprise to flourish. Although India's courts are notoriously inefficient, they at least comprise a functioning independent judiciary. Property rights are not fully secure, but the rule of law generally prevails.

High and inclusive growth is entwined with good governance and the Modi government is making efforts to take to it to the next level., the Union human resource development ministry wants to celebrate December 25 as 'good governance day', as on this day fall the birthdays of former Prime Minister Atal Bihari Vajpayee and Hindu Mahasabha leader Madan Mohan Malviya. Good leadership is the basic ingredient of governance. Quality leadership must be available at every level.

High and inclusive growth is entwined with good governance and the Modi government is making efforts to take to it to the next level., the Union human resource development ministry wants to celebrate December 25 as 'good governance day', as on this day fall the birthdays of former Prime Minister Atal Bihari Vajpayee and Hindu Mahasabha leader Madan Mohan Malviya. Good leadership is the basic ingredient of governance. Quality leadership must be available at every level.

Modi says, “The government cannot run merely on dreams. The government must be policy-driven. If governance is policy driven, those who have to execute those policies will be clear in their mind as to their functions, and responsibility and accountability will follow. When decisions are taken, the nation moves forward.”

Modi says, “The government cannot run merely on dreams. The government must be policy-driven. If governance is policy driven, those who have to execute those policies will be clear in their mind as to their functions, and responsibility and accountability will follow. When decisions are taken, the nation moves forward.”

Modi government has thus adopted the mantra of inclusive development – 'Sabka Saath Sabka Vikas'

E-governance has a major role to play in the efforts to establish good governance. Technology and innovation are the backbone of governance. Technology also plays a large role in creating and maintaining transparency.

Reducing public expenditure is yet another critical area. The government spends huge amount wages, pensions, interest payments, and agricultural subsidies and social sector schemes. Good governance calls for drastic reduction in wasteful public expenditure. Rational and inclusive growth oriented expenditure would lead us to a higher stage of advancement.

A long-established legal system has given India the underpinnings necessary for free enterprise to flourish. Although India's courts are notoriously inefficient, they at least comprise a functioning independent judiciary. Property rights are not fully secure, but the rule of law generally prevails.

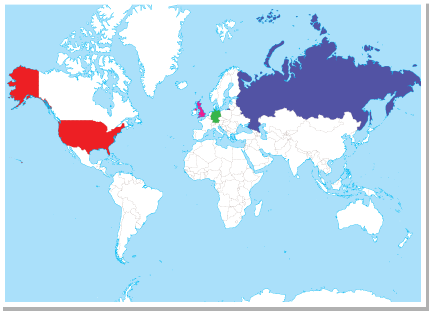

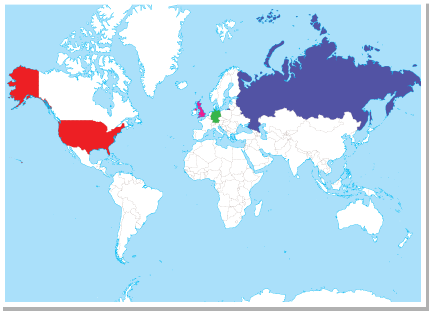

India & the West

India's diplomatic and strategic engagement with the Western countries has gone through radical changes in recent times. India maintains solid bilateral relations with the United States, United Kingdom, Germany and Russia.

India's diplomatic and strategic engagement with the Western countries has gone through radical changes in recent times. India maintains solid bilateral relations with the United States, United Kingdom, Germany and Russia.

India's claim for a permanent seat in the UN Security Council, as well as more responsibility in institutions such as the International Monetary Fund (IMF) and the World Bank is much dependent on good relation with the developed West.

The country is maintaining a balance with regard to bilateral relations with the United States and Russia. Prime Minister Narendra Modi's historical visit to the US resulted in strengthening of trade and strategic tie-up between the two countries.

The country is maintaining a balance with regard to bilateral relations with the United States and Russia. Prime Minister Narendra Modi's historical visit to the US resulted in strengthening of trade and strategic tie-up between the two countries.

US President Barack Obama was invited by Prime Minister Narendra Modi as the chief guest at India's Republic Day parade on 26 January 2015. He became the first US President to get that honour and also the first one to visit India twice while in office.

US President Barack Obama was invited by Prime Minister Narendra Modi as the chief guest at India's Republic Day parade on 26 January 2015. He became the first US President to get that honour and also the first one to visit India twice while in office.

While moving closure to the US, India never undermined its old and trusted friend Russia and recently it warmly welcomed Russian President Vladimir Putin. India and Russia signed agreements in oil exploration, infrastructure, defence and nuclear energy including construction of 12 Russian-built nuclear units in India over the next two decades.

While moving closure to the US, India never undermined its old and trusted friend Russia and recently it warmly welcomed Russian President Vladimir Putin. India and Russia signed agreements in oil exploration, infrastructure, defence and nuclear energy including construction of 12 Russian-built nuclear units in India over the next two decades.

India's claim for a permanent seat in the UN Security Council, as well as more responsibility in institutions such as the International Monetary Fund (IMF) and the World Bank is much dependent on good relation with the developed West.

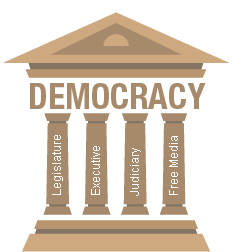

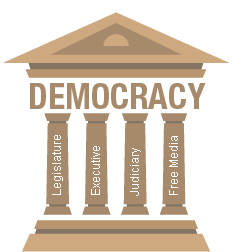

DEMOCRACY

India is the world's largest democracy. It is a nuclear weapons power and has joined the elite space club. India would be the third largest economy in the world by 2050 and a middle income country by 2025. It has already become the second largest market in the world.

India is the world's largest democracy. It is a nuclear weapons power and has joined the elite space club. India would be the third largest economy in the world by 2050 and a middle income country by 2025. It has already become the second largest market in the world.

The appurtenances of democracy - adult suffrage, a free media, an independent judiciary, the rule of law, the sanctity of property rights - are essential for inclusive growth which in turn strengthens democratic institutions. Borrowed from British model of Parliamentary democracy, India has adopted best practices from every one. It is a republic where Constitution is supreme.

Elected legislature, executive, independent Judiciary and free media are four pillars of our democracy.

Democracy has given Indians an institutional framework for the exercise of political choice and freedom to express dissent. This has acted as an indispensable safety valve in an inequitable milieu with great discrepancies in the distribution of power and wealth. Democracy has given the weakest and the poorest a stake in the system. The Indian electorate now numbers more than 800 million, making Indian elections the largest organised single political activity even in human history. Democracy has proved to be the most effective instrument for the cherished pursuit of power

The appurtenances of democracy - adult suffrage, a free media, an independent judiciary, the rule of law, the sanctity of property rights - are essential for inclusive growth which in turn strengthens democratic institutions. Borrowed from British model of Parliamentary democracy, India has adopted best practices from every one. It is a republic where Constitution is supreme.

Elected legislature, executive, independent Judiciary and free media are four pillars of our democracy.

Democracy has given Indians an institutional framework for the exercise of political choice and freedom to express dissent. This has acted as an indispensable safety valve in an inequitable milieu with great discrepancies in the distribution of power and wealth. Democracy has given the weakest and the poorest a stake in the system. The Indian electorate now numbers more than 800 million, making Indian elections the largest organised single political activity even in human history. Democracy has proved to be the most effective instrument for the cherished pursuit of power

Indian laws/Judiciary

The Indian Judicial System is one of the oldest legal systems in the world today. It is part of the inheritance India received from the British after more than 200 years of their Colonial rule, and the same is obvious from the many similarities the Indian legal system shares with the English Legal System. The frame work of the current legal system has been laid down by the Indian Constitution and the judicial system derives its powers from it. Now a debate on the need to repeal obsolete laws has been set in motion in India with the government appointing a committee to look into the matter.

The Indian Judicial System is one of the oldest legal systems in the world today. It is part of the inheritance India received from the British after more than 200 years of their Colonial rule, and the same is obvious from the many similarities the Indian legal system shares with the English Legal System. The frame work of the current legal system has been laid down by the Indian Constitution and the judicial system derives its powers from it. Now a debate on the need to repeal obsolete laws has been set in motion in India with the government appointing a committee to look into the matter.

The Law Commission of India under the aegis of the Ministry of Law & Justice in India is responsible for introducing India law reforms and implementation. The first Law Commission of Independent India was constituted in 1955 by the Government of India for democratic Indian law reforms in accordance with the directives laid down by the Constitution of India. The primary objective behind setting up of the Law Commission was to introduce suitable changes in pre-Constitution laws recognized by the Constitution of India under article 372, as and when required.More...

The Law Commission of India under the aegis of the Ministry of Law & Justice in India is responsible for introducing India law reforms and implementation. The first Law Commission of Independent India was constituted in 1955 by the Government of India for democratic Indian law reforms in accordance with the directives laid down by the Constitution of India. The primary objective behind setting up of the Law Commission was to introduce suitable changes in pre-Constitution laws recognized by the Constitution of India under article 372, as and when required.More...

India of my dreams

For many, India of their dreams is a place for equal opportunities, where all the talented people are given equal opportunities for growth irrespective of their caste, gender and economic and social status. India is witnessing a jobless growth even while it is very young country with regard to workforce. One hopes that one day every youth of the country will get a job and employability would be achieved through large-scale skill development programmes.

Women safety and empowerment is yet another dream. Lessening of economic disparity across various social strata in the country is another cherished goal.

Women safety and empowerment is yet another dream. Lessening of economic disparity across various social strata in the country is another cherished goal.

While friendly ties with India and Pakistan as well as with India and other countries in the world become the priority for a majority, an improvement in living standards is the concern of all those who are Below Poverty Line at present.

While friendly ties with India and Pakistan as well as with India and other countries in the world become the priority for a majority, an improvement in living standards is the concern of all those who are Below Poverty Line at present.

In India, democracy can be actualised in the true sense of the term if Indian politics can do away with casteism, vote bank politics, nepotism and criminalisation. For many, this is the India of their dreams. Honest, politically free and committed bureaucracy is a dream of many, especially who are into social activism, whereas quick justice and judicial activism are seen as an end and not as means by many towards the 'India of my dreams'.

In India, democracy can be actualised in the true sense of the term if Indian politics can do away with casteism, vote bank politics, nepotism and criminalisation. For many, this is the India of their dreams. Honest, politically free and committed bureaucracy is a dream of many, especially who are into social activism, whereas quick justice and judicial activism are seen as an end and not as means by many towards the 'India of my dreams'.

Defence

Indian Defence capability is ranked 4th in the world with the 2nd largest army at its command. The President of India himself serves as the Supreme Commander of Indian Armed Forces composed of Indian Army, Indian Navy and Indian Air Force.

In India, defence forces have grown from strength to strength after every major armed conflict and military operation in the past 60 years. In the current geopolitical context, India is faced with a complex array of internal as well as external security threats and the Indian Armed Forces are well-equipped to deal with them. India spends huge amount to enhance its military capabilities.

In India, defence forces have grown from strength to strength after every major armed conflict and military operation in the past 60 years. In the current geopolitical context, India is faced with a complex array of internal as well as external security threats and the Indian Armed Forces are well-equipped to deal with them. India spends huge amount to enhance its military capabilities.

Former defence minister Manohar Parrikar recently told Parliament that the total expenditure on “direct payments to foreign vendors for capital acquisitions”

for the Army, Navy and IAF during the last five years stood at

Rs 1,03,535 crore ($16.72 billion).

India is the world's largest arms importer due to a stagnant defence-industrial base (DIB), which forces the armed forces to acquire 65 per cent of their requirements from abroad.

The Modi government has enhanced Foreign Direct Investment in defence sector from 26 per cent to 49 per cent and the move aims at increasing domestic production and less dependence on imports. However, defence sector needs structural reforms to increase domestic production.

Former defence minister Manohar Parrikar recently told Parliament that the total expenditure on “direct payments to foreign vendors for capital acquisitions”

for the Army, Navy and IAF during the last five years stood at

Rs 1,03,535 crore ($16.72 billion).

India is the world's largest arms importer due to a stagnant defence-industrial base (DIB), which forces the armed forces to acquire 65 per cent of their requirements from abroad.

The Modi government has enhanced Foreign Direct Investment in defence sector from 26 per cent to 49 per cent and the move aims at increasing domestic production and less dependence on imports. However, defence sector needs structural reforms to increase domestic production.

Elections

Fair and free elections are the backbone of our democracy. From Lok Sabha to local bodies, elections have become a part of our life and a strong tool for empowerment. But Lok Sabha elections 2014 was different from the previous ones in more that one ways. After a very long period (over 30 years) a single party got majority on its own. The elections were personality centric.

Seasoned journalist Rajdeep Sardesai's book ‘2014: The Election that Changed India' provides a perspective into how elections in India are now much more complex than the conventional tussle of ballots. The elections 2014, including some Assembly elections in states like Maharashtra and Haryana marked the unprecedented shift in poll campaign strategy and the role played by the Media & PR Network. Indeed this time, the Congress Party lost the election before it entered the electoral fray and the Modi as ‘factor' emerged there to establish a new identity.

Seasoned journalist Rajdeep Sardesai's book ‘2014: The Election that Changed India' provides a perspective into how elections in India are now much more complex than the conventional tussle of ballots. The elections 2014, including some Assembly elections in states like Maharashtra and Haryana marked the unprecedented shift in poll campaign strategy and the role played by the Media & PR Network. Indeed this time, the Congress Party lost the election before it entered the electoral fray and the Modi as ‘factor' emerged there to establish a new identity.

The elections clearly manifested that youth was no longer ready to digest the blunders done by the previous UPA regimes.More...

The elections clearly manifested that youth was no longer ready to digest the blunders done by the previous UPA regimes.More...

Politics

‘If politics decides your future, decide what your future politics should be,' goes the proverbial importance of politics. In India, Bharatiya Janata Party finally swept the entire India in its wave. The wave of ‘hope' had consumed everyone, and rightly so. States that were conventionally not the seat of power for BJP came under the umbrella with the hope of ‘acche din'. Modi assumed the mantle of power and right now, as things seem, we are seeing a rather unconventional mode of politics and governance. The year 2014 was something that triggered a series of changes in India and the trickle effect will possibly cover the entire 2015 to settle down and give a final picture. A changed political landscape would result in two important aspects in times to come. Indian politics was, since independence, dominated by vote banks politics based on religion, caste and other class factors and forces. Now ‘development' has become the catch word and youth want change, jobs not debate over Babri Mosque or any divisive issues. Smart politicians have realised the change mind set of the youth and the graffiti is on the wall!

Indian Economy

With the new government taking over this year, India seems to be back on course to getting back to the growth rates seen earlier in the best years. The international sentiment is very bullish on India and that confidence is reflected with India receiving in excess of US$ 15 billion in FII till the mid of November 2014.

The Sensex has crossed record levels of 28,000 offering the best YTD Returns of 33.2%, after touching lows of 17,000 in September 2013 and is expected to rise even further by the end of the current fiscal. By any standard, this is indeed a smart recovery. In fact, India has been the star amongst BRICS nations in the recovery period, post the global slowdown.

The Sensex has crossed record levels of 28,000 offering the best YTD Returns of 33.2%, after touching lows of 17,000 in September 2013 and is expected to rise even further by the end of the current fiscal. By any standard, this is indeed a smart recovery. In fact, India has been the star amongst BRICS nations in the recovery period, post the global slowdown.

The agriculture and allied sectors have been erratic in growth rates and the period in question has not shown consistent growth or decline, in fact there have been sharp growth and decline in respective years.

With the new government demonstrating serious intent in reforming the economy by initiating steps towards reforms in land acquisition laws, labour laws, introducing GST, increasing FDI in Insurance, Railways, Construction, Infrastructure and Defence. Sensitive issues like deregulation of diesel have been initiated, while the coal and mining sector is being given an impetus through fresh auctions. Policies pertaining to clearances from the Environment and Forests are being revised to ensure faster clearances of projects.

The fall in global commodity prices, especially crude oil has helped India improve its Balance of Payments situation. The domestic financial investors have also shown marked improvement in sentiment with mutual funds that were net sellers in the last couple of years having turned net buyers this year. Mutual funds alone have pumped in 25,000 crore in equities this year.

The fall in global commodity prices, especially crude oil has helped India improve its Balance of Payments situation. The domestic financial investors have also shown marked improvement in sentiment with mutual funds that were net sellers in the last couple of years having turned net buyers this year. Mutual funds alone have pumped in 25,000 crore in equities this year.

GDP Growth

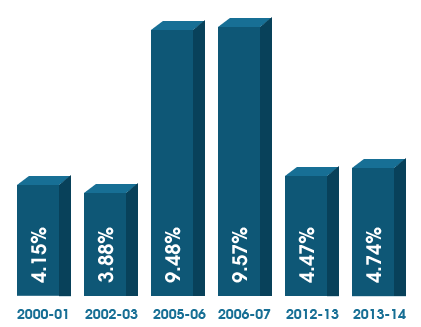

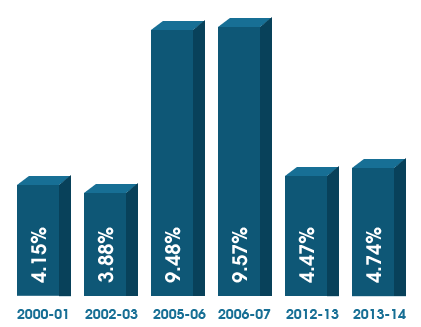

The Indian economy showed itself to be more robust than most of the other BRICS nations through the difficult years from 2010-2013. From 2000-2014, the economy saw its lowest GDP growth rate of 4.15% (2000-2001), 3.88% (2002-2003), 4.47% (2012-2013) and 4.74% (2013-2014). The best years saw growth rates touch 9.48% (2005-2006) and 9.57% (2006-2007). The economy has begun to recover and is expected to post growth rate above 5% for the current period of 2014-2015) and the economy is expected to continue to increase the pace of growth through 2017.

Industrial Growth

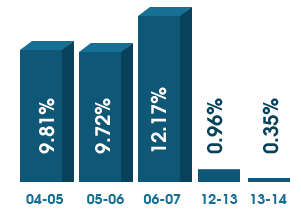

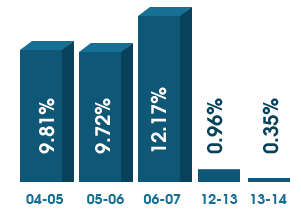

However, the industrial growth rates have shown a different trend. The highest growth rate of 12.17% was witnessed in 2006-2007, followed by 9.81% in 2004-2005 and 9.72% in 2005-2006. During the recession years, the industrial growth rate plummeted to 0.96% in 2012-2013 and 0.35% in 2013-2014. The industrial growth rate has been slow to post a recovery but current signs confirm that 2014-2015 will be better than the previous two years.The agriculture and allied sectors have been erratic in growth rates and the period in question has not shown consistent growth or decline, in fact there have been sharp growth and decline in respective years.