The Reserve Bank of India (RBI) has launched the UDGAM portal to streamline the retrieval process for unclaimed deposits. Known as the Unclaimed Deposits – Gateway to Access Information, the UDGAM portal serves as a centralized online platform, offering a comprehensive solution for individuals seeking their dormant deposits across various banks. This step comes in response to the growing trend of unclaimed deposits and is in line with the RBI’s commitment to fostering financial inclusivity and awareness.

Currently, the UDGAM portal provides details about unclaimed deposits from seven banks. It offers access to unclaimed deposit information from banks like the State Bank of India (SBI), Punjab National Bank, Central Bank of India, Dhanlaxmi Bank, South Indian Bank, and DBS Bank India for individual customers. Citibank is also included for non-individuals.

For those interested in utilizing the UDGAM portal, the access link is [https://udgam.rbi.org.in/unclaimed-deposits/#/login]. This portal marks a significant advancement in addressing the challenge of unclaimed deposits and contributes to creating a more efficient financial system.

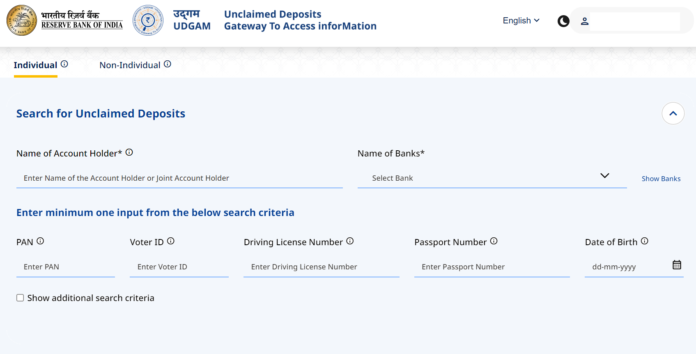

To use the portal, users need to complete a registration process by providing their mobile number, name, and password. Subsequently, they can log in using their registered mobile number and password. Verification is carried out through a One-Time Password (OTP) sent to the registered mobile number. After logging in, users provide the account holder and bank names, followed by selecting identification options such as PAN number, Voter ID, driving license number, or date of birth. Relevant details are entered, and users can choose the bank for their search.

The portal allows for the selection of multiple bank accounts. If the search criteria match, the portal displays associated account details; if not, it indicates “none.”

The UDGAM portal represents a significant step towards enhancing transparency and customer empowerment in the banking sector. By providing a centralized platform to locate unclaimed deposits, the RBI aims to facilitate the process of reclaiming rightful funds from various banks, thereby promoting financial inclusivity and awareness.

Previously, customers looking to claim deposits often had to navigate multiple bank websites. This new web portal simplifies the process by allowing customers to find their unclaimed deposits through a single point of access.

Deposits are considered unclaimed if there has been no activity on them for ten years or more. In such cases, banks transfer these amounts to the “Depositor Education and Awareness” (DEA) Fund managed by the RBI. However, depositors are still entitled to claim these deposits along with applicable interest from the bank(s) where the deposits were originally held.

The RBI highlights that the increase in unclaimed deposits is primarily attributed to the non-operation of savings or current accounts, unsubmitted redemption claims for matured fixed deposits, and funds belonging to deceased depositors where heirs fail to come forward for claims on the concerned bank(s).