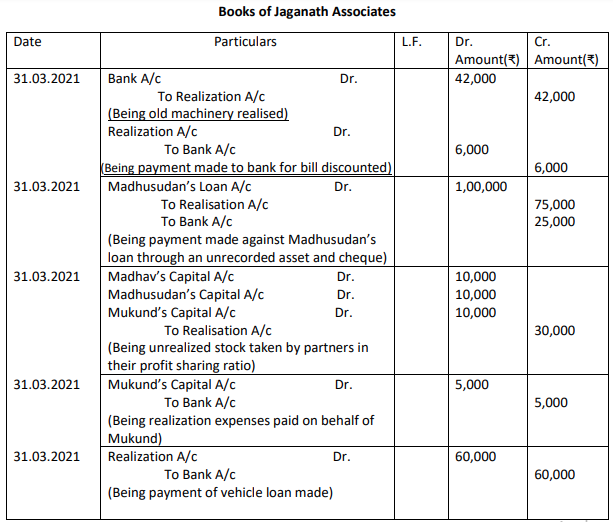

Madhav, Madhusudan and Mukund were partners in Jaganath

Associates. They decided to dissolve the firm on 31st March 2021.

Pass necessary journal entries for the following transactions after

various assets (other than cash) and third-party liabilities have been

transferred to realization account:

(i) Old machine fully written off was sold for ₹ 42,000 while a

payment of ₹ 6,000 is made to bank for a bill discounted being

dishonoured.

(ii) Madhusudan accepted an unrecorded asset of ₹80,000 at

₹75,000 and the balance through cheque, against the payment

of his loan to the firm of ₹1,00,000.

(iii) Stock of book value of ₹30,000 was taken by Madhav,

Madhusudan and Mukund in their profit sharing ratio.

(iv) The firm had paid realization expenses amounting to ₹5,000 on

behalf of Mukund.

(v) There was a vehicle loan of ₹ 2,00,000 which was paid by

surrender of asset to the bank at an agreed value of ₹ 1,40,000

and the shortfall was met from firm’s bank account.

Answer.