Vedansh Limited has a share capital of ₹10,00,000 divided into shares of ₹100 each .For expansion purpose ,the company requires additional funds of ₹ 5,00,000 . The management is considering the following alternatives for raising funds : Alternative 1: Issue of 5000 Equity shares of ₹100 each Alternative 2: Issue of 10% Debentures of Rs. 5,00,000 The company’s present Earnings Before Interest and Tax ( EBIT) is ₹4,00,000 p.a. Assuming that the rate of Return of Investment remains the same after expansion, which alternative should be used by the company in order to maximise the returns to the equity shareholders. The Tax rate is 50%. Show the working.

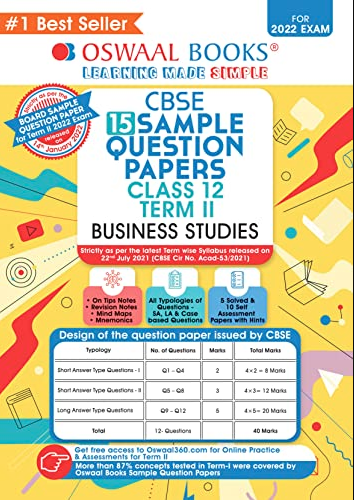

CBSE Sample Question Paper, Class 12 BUSINESS STUDIES Term 2 Question - Vedansh Limited has a share capital of ₹10,00,000 divided into shares of ₹100 each .For expansion purpose ,the company requires additional funds of ₹ 5,00,000 . The management is considering the following alternatives for raising funds : Alternative 1: Issue of 5000 Equity shares of ₹100 each Alternative 2: Issue of 10% Debentures of Rs. 5,00,000 The company’s present Earnings Before Interest and Tax ( EBIT) is ₹4,00,000 p.a. Assuming that the rate of Return of Investment remains the same after expansion, which alternative should be used by the company in order to maximise the returns to the equity shareholders. The Tax rate is 50%. Show the working.