Provident Fund, which is also known as pension fund, is an accumulated amount provided to the employees after retirement. It is a great financial instrument which could be extremely beneficial for an employee during old age. However, the fund can also be withdrawn in certain conditions. The Employee Provident Fund Organisation (EPFO), which is one of the largest organisations in the world in terms of volume of financial transactions, is responsible for maintaining the Provident Fund of the employees.

There are two ways to withdraw the PF amount-

- Online and

- Offline (Submitting a withdrawal form)

While filling withdrawal, there are two options –

- Only PF withdrawal – Form 19 has to be filled for this claim

- Only Pension Withdrawal – Form 10C has to be filled for pension withdrawal.

Form 19 – When one has to withdraw the accumulated PF which is also known as “final settlement”, form 19 has to be filled. One needs to fill his personal details and employment details which include date of leaving, reason of leaving services, date of joining services, PAN, UAN and Aadhaar Number, bank account details, full postal address, etc.

Form 10C – Form 10C is filled to withdraw PF amount which is accumulated as pension after 10 years of service. The pension amount is regulated as per Employee Pension Scheme, 1950, whereas the PF amount is regulated by the Employee Provident Fund Scheme, 1952.

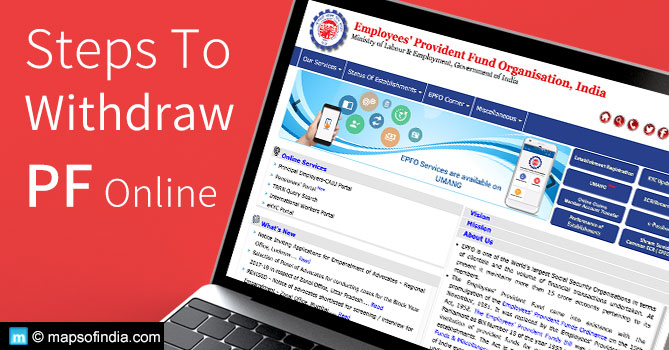

Ways to withdraw PF online-

The process of online withdrawal is extremely easy and is less time consuming.

You just need to follow certain steps to withdraw PF online-

- A candidate can file a withdrawal claim on the EPFO portal.

- Link- https://epfindia.gov.in/

How to fill an online claim for PF withdrawal?

- Login to the EPFO portal and enter the UAN and password.

- Click on “Manage” tab and choose the ‘Our Services’ option.

- Select option “claim” from the drop-down menu list.

- Choose the type of withdrawal (full, partial or half) under the option titled ‘I Want to Apply For’ when the drop down menu appears.

- The claim is generated and then forwarded to the employer for the approval. After the approval, the PF amount gets credited to subscriber’s account within 10 days.

It is important for the candidate to know his/her UAN number which is provided by the employer and is printed on the salary slip.

Before claiming the PF amount, the individual needs to complete the KYC documentation, and fill the bank details. UAN number should also be activated.

You can claim your PF online only if you meet the following conditions-

- You must be allotted a UAN number and it should be activated

- Your mobile number must be registered with the UAN

- Your bank details must be seeded into the UAN

- Your PAN and Aadhaar should be seeded into the EPFO Database

In case, the subscriber is unaware of his UAN number-

- Visit the above-mentioned link and click the tab named “ Know Your UAN status”

- Fill the required details.

- A message will be sent to the registered mobile number.

- Enter the authorisation PIN obtained through SMS.

- UAN number will also be sent to the subscriber through SMS.

Steps to activate UAN Number-

- Visit the EPFO website and click on “For Employees” option.

- Select the option “Our services”.

- Now, click on “Member UAN/ Online Services”.

- Choose the option “ Activate your UAN” when the UAN portal appears on the screen.

- Fill the form to generate authorisation pin and activate UAN.

- A password along with a confirmation SMS will be sent to the registered mobile number for the same.

How to withdraw PF offline?

To withdraw PF offline, the applicant has to submit a physical form.

The applicant can download and fill the composite claim form and submit it to the respective jurisdictional EPFO office without getting it attested from the employer. If you don’t have Aadhaar card, then EPF Composite Claim Form shall be submitted at the respective jurisdictional EPFO office after getting it attested by the employer.

When can one withdraw PF-

The cases in which PF can be withdrawn are-

- If you have changed your job or you want to withdraw your PF amount due to other reasons within ten years or less you will have to fill the composite claim form. Then you will have to choose the option of “Final PF Balance” and then “pension withdrawal’ option for withdrawing the amount.

- It is advisable to continue with the same PF account if you have changed the job as in future PF amount will act as accumulated savings.

- You can opt for withdrawing PF Balance if you are aged 50 years and above while working. If you have completed 10 years and above while working and your age is between 50-58 years then you have the option of getting reduced pension. For withdrawing the amount you will have to submit Form 10D and submit it along with the Composite Claim Form.

- You can withdraw your full PF amount if you are aged 58 and above and want to retire. For claiming the full pension, you will have to submit the same Form 10D.

- If an individual remains unemployed for a period of two months or more, then he can withdraw the complete PF amount provided the condition has to be certified by a gazetted officer.

Note: If there is a gap of two months between switching of one job to another, then complete withdrawal of PF is considered illegal and also against the PF rules and regulations.

Partial PF can be withdrawn in certain cases-

| Sl No | Particulars of reason for withdrawal | Limit for withdrawal | No of years of service criteria | Other conditions |

| 1 | Marriage | One can withdraw upto 50% employee share of EPF | 7 years | For the marriage of self or family members including son/daughter, brother/sister |

| 2 | Education | Upto 50% of employee’s share of contribution to EPF | 7 years | For the education of either himself or his / her children after passing class 10 |

| 3 | Purchase of land/ house or it’s construction | For land – upto 24 times of monthly wages + DA (Dearness allowance)

For house – upto 36 times of monthly wages + DA |

5 years | The land or the house should be registered in the name of the employee or spouse or Jointly. |

| 4 | Home loan repayment | Upto 90 %, from both employee’s contribution and employer contribution in EPF | 10 years | i. The property should be in name of the employee or spouse or jointly

ii. Withdrawal is permitted only if furnishing of requisite documents as called for by the EPFO relating to the housing loan availed is done. iii. The amount of money in PF account (or together with the spouse), including the interest, has to be more than Rs 20,000. |

| 5 | Renovation of house | Up to 12 times of the monthly wages | 5 years | The property should be registered in the name of the employee or spouse or jointly. |

| 6 | A little before retirement | Upto 90% of total accumulated balance with interest | Once he reaches 57 years ( as per recent amendment) | For personal requirement |

EPF Customer Care

The customer care deals with queries regarding balance, refund and transfer discrepancies. It also deals with delays and transferring of claims. In case of further query, you can also access the contact number and email ID of the regional EPF office.

To reach customer care-

- Visit the EPFO member portal – http://www.epfbng.kar.nic.in/

- Click on ‘contact us’.

- Check the toll free number of the EPF regional office and call for assistance.