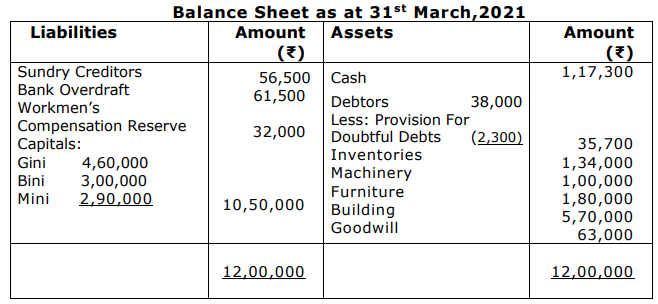

Gini, Bini and Mini were in partnership sharing profits and losses

in the ratio of 5:2:2. Their Balance Sheet as at 31st March, 2021

was as follows:

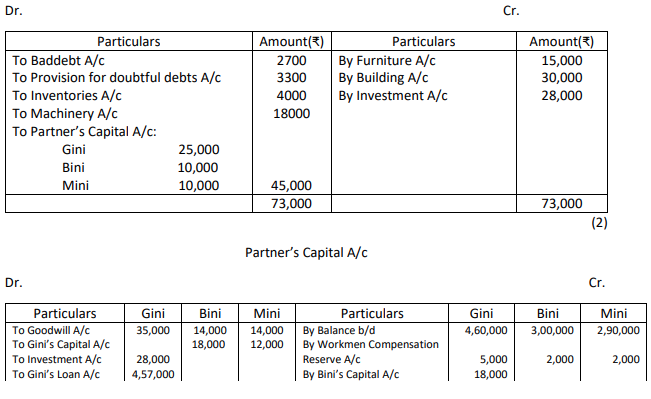

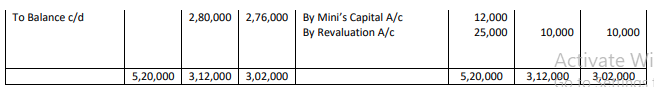

On 31st March, 2021, Gini retired from the firm. All the partners agreed to

revalue the assets and liabilities on the following basis:

(i) Bad debts amounted to ₹ 5,000. A provision for doubtful debts was

to be maintained at 10% on debtors.

(ii) Partners have decided to write off existing goodwill.

(iii)Goodwill of the firm was valued at ₹ 54,000 and be adjusted into

the Capital Accounts of Bini and Mini, who will share profits in future

in the ratio of 5:4.

(iv)The assets and liabilities valued as: Inventories ₹1,30,000;

Machinery ₹ 82,000; Furniture ₹1,95,000 and Building

₹ 6,00,000.

(v) Liability of ₹23,000 is to be created on account of Claim for

Workmen Compensation.

(vi)There was an unrecorded investment in shares of ₹ 25,000. It was

decided to pay off Gini by giving her unrecorded investment in full

settlement of her part payment of ₹ 28,000 and remaining amount

after two months.

Prepare Revaluation Account and Partners’ Capital Accounts as on 31st

March, 2021.

Answer.