Ever since the Modi government was elected to power at the centre in 2014, Foreign Direct Investment (FDI) has been in prime focus. Many economic policies, the ones pertaining to tax reforms and ease of doing business in particular, have been crafted with foreign investors in mind. The launch of Make in India is an attempt to channelize these FDI into key sectors thereby turning India into an important manufacturing and services hub of the world. Let us now take a look at how these economic policies and tax reforms have affected the investments of India’s key partner in economic affairs, Japan.

Japan is now the third largest foreign investor in India. The country is also the biggest investor as a “single country source”. Right from the start of this millennium, the FDI received by India from Japan amounts to about USD $ 25.67 billion. This adds up to about 8 percent of all the FDI received by us between 2000 and 2017. The importance of Japan as an investor cannot be stressed enough. Over the past year, the importance of Japan has registered a manifold increase. Japanese FDI has gone up from USD 1.3 billion (FY 20313-14) to USD 2.6 billion (FY 2015-16) to USD 4.7 billion (FY 2016-17).

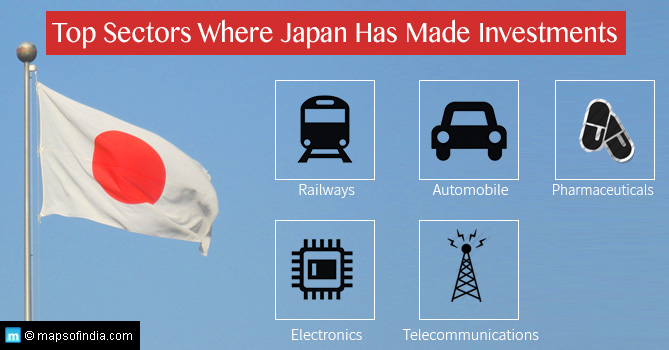

Key Sectors of Cooperation

Traditionally, Indians have seen Japanese presence in the form of investments and collaborations in sectors such as telecommunication, automobiles, heavy engineering, and pharmaceuticals & chemicals manufacturing. In recent times, however, the sheer diversity of the sectors receiving Japan’s investments is mind boggling.

Earlier this year, the Mizuho Financial Group, working for the Japanese government identified a number of sectors for investment and collaboration in India. These include automobiles, electronics, energy, infrastructure, and transportation. In 2015, Japan had pledged USD 33 billion in investments between 2014 and 2019 with particular emphasis on infrastructure and manufacturing.

Some of the key sectors that have received FDI from japan this year and are likely to be important areas of collaboration include banking and finance, retail, and consumer durables. Infrastructure, however, is likely to see the most development and investment from Japan in the time to come.

Industrial Parks in India

Japan has also decided to set up a collaboration with India and put up 12 industrial parks across the country. The locations that have been selected for the construction of these industrial parks are – Mandal in Gujarat, Ghilot in Rajasthan, Neemrana in Rajasthan, Jhajjar in Haryana, the Integrated Industrial Township in Greater Noida, Ponneri in Tamil Nadu, Tumkur in Karnataka, and Supa in Maharashtra. The government of India is attempting to fast track the process of setting up these parks.

India and Japan shall be setting up a forum for infrastructure development in the North Eastern states and shall jointly undertake implementation of strategic infrastructure projects in this region. Phase I of the USD 610 million North East Road Network Connectivity Improvement Project is now all set to take off. Japan is also planning to construct a war memorial dedicated to Japanese soldiers who lost their lives in Manipur during World War II. Apart from this, the Japanese government is also lending its support in setting up special economic corridors through the country. According to a survey, the state that has been the greatest recipient of FDI from Japan is Haryana.

A Growth Story

Relations between India and Japan are at an all-time high. This is a fact that most economists and corporate leaders agree on. Japan’s footprints in India are growing stronger each passing year. Over the past year alone there has been a considerable increase in the number of Japanese companies in India. News reports suggest that as of October 2016 there were 1,305 Japanese companies registered in India. This was a 6 percent increase over 2015 estimates and it looks very likely that the number of companies in 2017 will be more that 2016 figures.

While there are these numerous instances of successful partnerships between the two nations, there are also hiccups faced by a few such as Ricoh India – the Indian subsidy of the Japanese digital imaging equipment manufacturer. The Indian unit has succumbed to numerous scams and the Japanese parent company is now trying to recover these losses.

Despite such instances, economists and corporate head honchos of India agree that these two Asian economies complement each other very well. The two nations are on a grand path for economic and cultural bonding and the potential for growth for these collaborations is immense.