Short Answer Type Questions

Q1. What is ‘Depreciation’?

Solution:

Depreciation means fall in book value of depreciable fixed asset because of

1. wear and tear of the asset

2. passage/efflux of time

3. obsolescence

4. accident

A machinery costing ₹ 1,00,000 and its useful life is 10 years; so, depreciation is calculated as:

Annual Depreciation per annum

= Cost of Asset-Estimated Scrap Value/Expected or Estimated life of Asset

= 100000/10 = ₹ 10,000

Q2. State briefly the need for providing depreciation.

Solution:

The needs for providing depreciation are given below.

1. To ascertain the correct profit or loss: Correct profit or loss can be ascertained when all the expenses and losses incurred for earning revenues are charged to Profit and Loss Account. Assets are used for earning revenues and its cost is charged in form of depreciation from Profit and Loss Account.

2. To show true and fair view of financial statements: If depreciation is not charged, assets will be shown at higher value than their actual value in the balance sheet. Consequently, the balance sheet will not reflect true and fair view of financial statements.

3. For ascertaining the accurate cost of production: Depreciation on the assets, which are engaged in production, is included in the cost of production. If depreciation is not charged, the cost of production is underestimated, which will lead to low selling price and thus leads to low profit.

4. To provide funds for replacement of assets: Unlike other expenses, depreciation is non cash expense. So, the amount of depreciation debited to the profit and loss account will be retained in the business. These funds will be available for replacement of fixed assets when its useful life ends.

5. To meet the legal requirement: To comply with the provisions of the Companies Act and Income Tax Act, it is necessary to charge depreciation.

Q3. What are the causes of depreciation?

Solution:

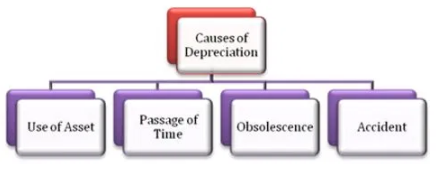

1. Use of asset: Because of constant use of the fixed assets there exists a normal wear and tear which leads to fall in the value of the assets.

2. Passage of time: Whether assets are used or not, with the passage of time, its effective life will decrease.

3. Obsolescence: Because of new technologies, innovations and inventions, assets purchased currently may become outdated later which leads to the obsolescence of fixed assets.

4. Accident: An asset may lose its value due to mishaps such as a fire accident, theft or by natural calamities and they are permanent in nature.

Q4. Explain basic factors affecting the amount of depreciation.

Solution:

1. Original cost of asset:The total cost of an asset is taken into consideration for ascertaining the amount of depreciation. The total cost of an asset include all expenses incurred up to the point the asset is ready for use like freight expenses and installation charges.

Total Cost= Purchase Price+ Freight Expenses+ Installation Charges.

2. Estimated useful life:Every asset has its useful life other than its physical life in terms of number of years and units used by a business. The asset may exist physically but may not be able to produce the goods at a reasonable cost. For example, an asset is likely to lose its useful value within 15years, its useful life, i.e., life for purpose of accounting should be considered as only 15 years

3. Estimated scrap value:It is estimated as the net realisable value of an asset at the end of its useful life. It is deducted from the total cost of an asset and the difference is written off over the useful life of the asset. For example, Furniture acquired at ₹ 1,30,000, its useful life is estimated to be 10 years and it is estimated scrap value ₹ 10,000.

Depreciation per annum= 1,30,000-10,000/10 years= 12,000

Q5. Distinguish between straight line method and written down value method of calculating depreciation.

Solution:

Straight Line Method

Written Down Value Method

Depreciation is calculated on the original cost of an asset.

Depreciation is calculated on the reducing balance, i.e., the book value of an asset.

Equal amount of depreciation is charged each year over the useful life of the asset.

Diminishing amount of depreciation is charged each year over the useful life of the asset.

Book value of the asset becomes zero at the end of its effective life.

Book value of the asset can never be zero.

It is suitable for the assets such as patents, copyright, land and buildings which have lesser possibility of obsolescence and lesser repair charges.

It is suitable for assets which needs more repair in the later years such as plant and machinery and car.

As depreciation remains same over the years but repair cost increases in the later years, there will be unequal effect over the life of the asset.

As depreciation cost is high and repairs are less in the initial years but in the latter years the repair costs increase and depreciation cost decreases, there will be equal effect over the life of the asset.

It is not recognised under the income tax act.

It is recognised under the income tax act.

Q6. “In case of a long term asset, repair and maintenance expenses are expected to rise in later years than in earlier year”. Which method is suitable for charging depreciation if the management does not want to increase burden on profits and loss account on account of depreciation and repair.

Solution:

The written down value method is most appropriate to overcome the burden of the profit and loss account because of high depreciation and repair costs over the years of the asset. The cost of depreciation reduces and the repair and maintenance expenses increase over the yea₹ However, the entire burden will not get ease to the management.

Q7. What are the effects of depreciation on profit and loss account and balance sheet?

Solution:

The effects of depreciation on Profit and Loss Account are as follows:

1. An increase in depreciation will be debited in the profit and loss account which reduces net profit.

2. Hence total expenses increase which leads to an excess of debit over credit balance.

The effects of depreciation on Balance Sheet are as follows:

1. The original cost or book value of the concerned asset gets reduced.

2. The overall balance of asset’s column in the balance sheet gets reduced.

Q8. Distinguish between ‘provision’ and ‘reserve’.

Solution:

Provision

Reserve

It is charge against profit.

It is an appropriation of profit.

It is created to meet a specific liability or contingencies.

It is made for strengthening the financial position of the business. Some reserves are also mandatory under law.

It is recorded on the debit side of profit and loss account.

It is recorded on the credit side of the profit and loss appropriation account.

It can be shown either (i) by way of deduction from the item on the assets side for which it is created, or (ii) in the liabilities side along with the current liabilities.

It is shown on the liabilities side after capital.

It cannot be utilized for dividend distribution.

It can be utilized for dividend distribution.

It is never invested outside the business.

It can be invested outside the business.

It reduces net profits.

It reduces only divisible profit.

Q9. Give four examples each of ‘provision’ and ‘reserves’.

Solution:

Four examples of provision are given below.

1. Provision for bad and doubtful debts

2. Provision for discount on debtors

3. Provision for depreciation

4. Provision for tax

Four examples of reserve are given below.

1. General reserve

2. Capital redemption reserve

3. Dividend equalisation reserve

4. Debenture redemption reserve

Q10. Distinguish between ‘revenue reserve’ and ‘capital reserve’.

Solution:

Revenue Reserve

Capital Reserve

It is formed out of revenue profit which is earned from normal activities of business operations.

It is formed out of capital profit which is a gain from other than normal activities of business operations, such as sale of fixed assets.

It can be used for distribution of dividend.

It cannot be used for distribution of dividend.

It is created for increasing the financial position of the business.

It is created for the purpose of the Companies Act.

Q11. Give four examples each of ‘revenue reserve’ and ‘capital reserve’.

Solution:

Examples of revenue reserve are as follows:

1. General reserve

2. Investment equalisation reserve

3. Dividend equalisation reserve

4. Debenture reserve

Examples of capital reserve are as follows:

1. Issues of shares at premium

2. Profit on forfeiture of shares

3. Profit on sale of fixed assets

4. Profit on redemption of debentures

Q12. Distinguish between ‘general reserve’ and ‘specific reserve’.

Solution:

Specific Reserve

General Reserve

It is created for specific purpose.

It is not created for specific purpose.

It is not available for any future contingencies or expansion of business. It is utilised only for that purpose for which it is created.

It is available for any future contingencies or expansion of business. It strengthens the financial position.

Dividend equalisation reserve, debenture redemption reserve, development rebate reserves.

Contingency reserve and general reserve

Q13. Explain the concept of ‘secret reserve’.

Solution:

Secret reserves are created by overstating liabilities or understating assets which are not shown in the balance sheet. This will reduce tax liabilities, because the liabilities are overstated. It is created by management to avoid competition by reducing profit. Creation of secret reserve is not allowed by Companies Act, 1956 which requires full disclosure of all material facts and accounting policies while preparing final statements.

Long Answer Type Questions

Q1. Explain the concept of depreciation. What is the need for charging depreciation and what are the causes of depreciation?

Solution:

Depreciation means fall in book value of depreciable fixed asset because of

1. wear and tear of the asset,

2. passage/efflux of time,

3. obsolescence, or

4. accident.

The need for providing depreciation is:

1. To ascertain the correct profit:Correct profit or loss can be ascertained when all the expenses and losses incurred for earning revenues are charged to Profit and Loss Account. Assets are used for earning revenues and its cost is charged in form of depreciation from Profit and Loss Account.

2. To show true and fair view of the financial position:If depreciation is not charged, assets will be shown at higher value than their actual value in the balance sheet. Consequently, the balance sheet will not reflect true and fair view of financial statements.

3. To retain, out of profit, funds for replacement:Unlike other expenses, depreciation is non cash expense. So, the amount of depreciation debited to the profit and loss account will be retained in the business. These funds will be available for replacement of fixed assets when its useful life ends.

4. To ascertain correct cost of production:Depreciation on the assets, which are engaged in production, is included in the cost of production. If depreciation is not charged, the cost of production is underestimated, which will lead to low selling price and thus leads to low profit.

5. To meet the legal requirement:To comply with the provisions of the Companies Act and Income Tax Act, it is necessary to charge depreciation.

The causes of depreciation are as stated below:

1. Use of Asset i.e., wear and tear:Due to constant use of the fixed assets there exist a normal wear and tear that leads to fall in the value of the assets.

2. Passage/Efflux of Time:Whether assets are used or not, with the passage of time, its effective life will decrease.

3. Obsolescence:Due to new technologies, innovations and inventions, assets purchased today may become outdated by tomorrow which leads to the obsolescence of fixed assets.

4. Accidents:An asset may lose its value due to mishaps such as a fire accident, theft or by natural calamities and they are permanent in nature.

Q2. Discuss in detail the straight line method and written down value method of depreciation.Distinguish between the two and also give situations where they are useful.

Solution:

The two methods of depreciation are

1. Fixed percentage on original cost or straight line method

2. Fixed percentage on diminishing balance or written down value method

Straight Line Method

According to this method, a fixed and equal amount is charged as depreciation for every accounting period during the life time of an asset. This method is based on the assumption of equal usage of time over asset’s entire useful life. Hence, the amount of depreciation is same from period to period over the life of the asset.

Depreciation amount can be calculated by using the following formula:

If the asset has a residual value at the end of its useful life, the amount to be written of every year is as follows:

Depreciation = Cost of asset – Estimated net residual value / No. of years of expected life

If the annual depreciation amount is given then we can calculate the rate of depreciation as follows:

Rate of depreciation = Annual depreciation amount / Cost of asset * 100

Advantages of Straight Line Method

1. Simple to calculate the depreciation amount

2. Assets can be depreciated up to the estimated scrap value

3. Easy to understand the amount of depreciation

4. Every year, the same amount of depreciation is debited to profit and loss account, and hence the effect on profit and loss account will remain the same.

Disadvantages of Straight Line Method

1. Interest on capital invested in assets is not provided in this method.

2. Over the years, the work efficiency of assets decreases and repair expenses increases. Therefore, there is burden on the profit and loss account.

3. Book value of the assets becomes zero but still the assets are used in the business.

Written Down Value Method

In this method depreciation is charged on the book value of the asset and the amount of depreciation reduces year after year. It implies that a fixed rate on the written down value of the asset is charged as depreciation every year over the expected useful life of the asset. The rate of depreciation is applicable to the book value but not to the cost of asset.

Rate of depreciation can be ascertained on the basis of cost, scrap value and useful life of the asset as follows:

Where, R is the rate of depreciation in percent, n is the useful life of the asset; S is the scrap value at the end of useful life and C is the cost of the asset.

Advantages of Written Down Value Method

1. The profit and loss account of depreciation and repair expenses has same weightage throughout the useful life of asset because depreciation decreases with an increase in repair expenses.

2. Since the benefits from asset keep on decreasing, the cost of asset is allocated rationally.

3. This method is most favorable for those assets which require increased repairs and maintenance expenses over the years.

4. This method is widely accepted under the Income Tax Act.

Disadvantages of Written Down Value Method

1. The value of assets can never be zero even though it is discarded.

2. In this method, it is difficult to calculate depreciation.

3. There is no provision of interest on capital invested in use of assets.

Difference between Straight Line and Written Down Value Method

Straight Line Method

Written Down Value Method

Depreciation is calculated on the original cost of fixed asset

Depreciation is calculated on the book value (i.e. original cost less depreciation) of fixed asset

Amount of depreciation remains constant for all years

Amount of depreciation keeps on decreasing year after year

At the end of the useful life of an asset, the balance in the asset account will reduce to zero

At the end of the useful life of an asset, the balance in the asset account will not reduce to zero

It is not accepted by Income Tax Law

It is accepted by Income Tax Law

It is suitable for assets which get completely depreciated on the account of expiry of its useful life

It is suitable for assets which require more and more repairs in the later stage of its useful life

Rate of depreciation is easy to calculate

Rate of depreciation is difficult to calculate

Q3.Describe in detail two methods of recording depreciation. Also give the necessary journal entries.

Solution:

The two methods of recording depreciation are as follows:

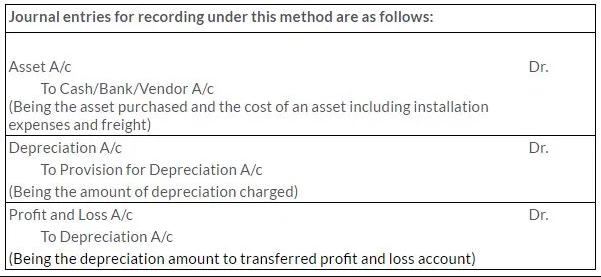

1. When Depreciation is Charged or Credited to the Assets Account

In this method, depreciation is deducted from the asset value and charged (debited) to profit and loss account. Hence the asset value is reduced by the amount of depreciation.

In the Balance sheet, asset appears at its written down value which is cost less depreciation charged till date. In this method, the original cost of an asset and the total amount of depreciation which has been charged cannot ascertain from this balance sheet.

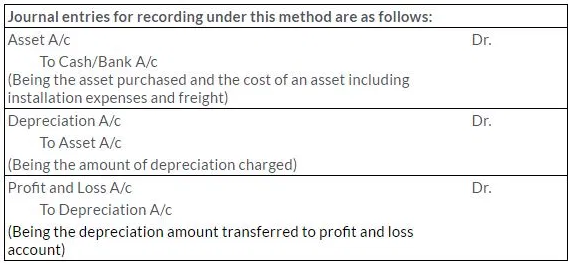

2. When Depreciation is Credited to Provision for Depreciation Account

In this method, depreciation is credited to the provision for depreciation account or accumulated depreciation account every year. Depreciation is accumulated in a separate account instead of adjusting into the asset account at the end of each accounting period. In the balance sheet, the asset will continue to appear at the original cost every year. Thus, the balance sheet shows the original cost of the asset and the total amount of depreciation charged on asset.