Harihar, Hemang and Harit were partners with fixed capitals of

₹3,00,000, ₹ 2,00,000 & ₹ 1,00,000 respectively. They shared profits

in the ratio of their fixed capitals. Harit died on 31st May, 2020,

whereas the firm closes its books of accounts on 31st March every

year. According to their partnership deed, Harit’s representatives

would be entitled to get share in the interim profits of the firm on the

basis of sales. Sales and profit for the year 2019-20 amounted to

₹8,00,000 and ₹2,40,000 respectively and sales from 1st April, 2020

to 31st May 2020 amounted to ₹ 1,50,000. The rate of profit to sales

remained constant during these two years. You are required to:

(i) Calculate Harit’s share in profit.

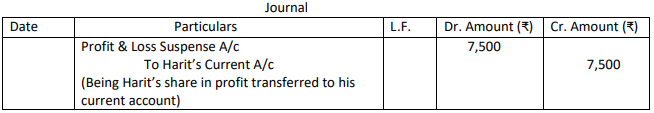

(ii) Pass journal entry to record Harit’s share in profit.

Answer.

(i) Ratio of Profit to sales= 2,40,000/8,00,000 X 100 = 30%

Profit upto the date of death= 1,50,000 X 30% = ₹45,000

Profit sharing Ratio = 3:2:1

Harit’s Share of Profit = 45,000 X 1/6 = ₹7,500

Alternative: Harit’s Share of Profit = 2,40,000/8,00,000 X 1,50,000 X 1/6=₹7,500