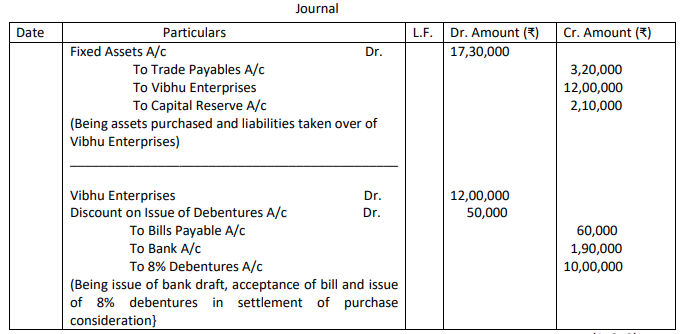

Vedesh Ltd. purchased a running business of Vibhu Enterprises for a

sum of ₹ 12,00,000. Vedesh Ltd. paid ₹ 60,000 by drawing a

promissory note in favour of Vibhu Enterprises., ₹1,90,000 through

bank draft and balance by issue of 8% debentures of ₹ 100 each at a

discount of 5%. The assets and liabilities of Vibhu Enterprises

consisted of Fixed Assets valued at ₹ 17,30,000 and Trade Payables

at ₹ 3,20,000.

You are required to pass necessary journal entries in the books of

Vedesh Ltd.

Answer.

In the Books of Vedesh Ltd.

Working Note:

Number of Debentures issued = 9,50,000 / 95 = 10,000