The central government unveiled India’s budget for the fiscal year beginning April 1, days after a disastrous third Covid-19 wave crippled small companies and intensified the country’s already massive inequities.

Finance Minister Nirmala Sitharaman introduced a budget on February 1, 2022 that asks for more spending to boost development in Asia’s third-largest economy, which is undergoing a world-beating comeback from the epidemic.

To boost economic objectives, Sitharaman suggested increasing the size of the economy’s yearly spending to 39.5 lakh crore ($529 billion).

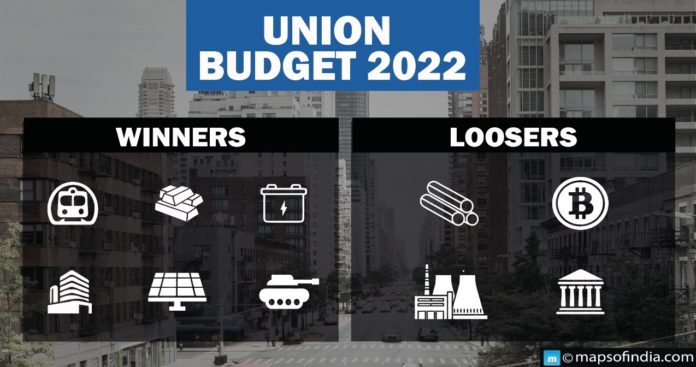

Here’s a rundown of who won and who lost during the budget announcement:

Winners

- Transport, Infrastructure

Improvements in secluded roads, public transportation in cities, and the project of 400 new “Vande Bharat” trains over the next three years will benefit significant infrastructure players such as Indian Railway Catering and Tourism Corp, Allcargo Logistics Ltd., Container Corporation of India Ltd., IRB Infra Ltd., KNR Constructions Ltd., GMR Infrastructure Ltd., and Larson & Toubro Ltd.

- Metals

The government’s commitment of 600 billion rupees for water supply to 38 million houses and logistical investments would assist India’s metals companies, notably JSW Steel Ltd., Tata Steel Ltd., Vedanta Ltd., and Pipemakers such as Jain Irrigation Systems Ltd., Jindal Stainless Ltd., Kirloskar Brothers Ltd., KSB Ltd. may also gain.

- EV Battery Makers

Battery manufacturers will benefit from a new changing policy for electric vehicles unveiled by Nirmala Sitharaman, which is critical for initiatives to boost India’s objectives to promote sustainable transportation technology. Amara Raja Batteries Ltd. and Exide Industries Ltd. would be among the winners.

- Cement, Construction

According to the finance minister, around 80 lakh dwellings would be finished in Fiscal Year 2023. The government has also allocated Rs 48,000 crore to the PM Awas Yojana.

- Solar

Manufacturing incentives of Rs 19,500 crore for solar panels would shift the emphasis of development at top panel makers such as Reliance Industries Ltd., Adani Enterprises Ltd., Suzlon Energy Ltd., and Tata Power Ltd.

- Defence Manufacturers

Defence equipment manufacturers hope to gain from Nirmala Sitharaman’s judgement to allocate 68% of industry investment to domestic firms in the yearly budget. Space Technologies Ltd., Paras Defence, Bharat Forge Ltd., and Larsen & Toubro Ltd. are winners. BotLab Dynamics, New Space India Ltd, and Zeus Numerix are among the drone manufacturers that might profit.

Losers

- Stainless Steel

Given the surge in metal prices, India intends to repeal anti-dumping and compensatory levies on stainless steel, coated steel flat goods, alloy steel bars, and high-speed steel. It is likely to impact the two largest producers, Tata Metaliks Ltd. and Jindal Stainless Ltd.

- Crypto Players

Cryptocurrency investors received the short end of the stick since all of its revenues would be taxed at 30%. While this eliminates the danger of a total ban on digital assets, it will decrease investors’ interest and reduce their speculative income. Coin switch Kuber, CoinDCX, Zebpay, and WazirX are impacted.

- Coal and Thermal Power

Coal India Ltd., Singareni Collieries Co., Adani Enterprises Ltd., and others should watch India’s solar power subsidies. The government plans to employ biomass pellets in thermal power plants to reduce reliance on coal. The firms mentioned above are importers of coal.

- State-Run Banks

India intends to launch a digital currency, changing the regulations for traditional banking to keep up with the worldwide movement toward digital financial products. The move affected Punjab National Bank, Bank of India, Union Bank of India, Canara Bank, Bank of Baroda, and State Bank of India Ltd.