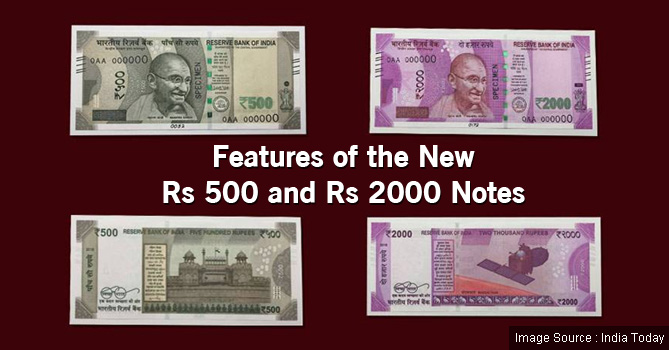

It has been exactly one year since Prime Minister Narendra Modi launched what has been decreed India’s greatest offensive against black money – the demonetisation of INR 500 (old) and INR 1000 notes. Delivered a bolt from the blue, the PM addressed the nation on Friday (8 November, 2016) at about 8 pm and said that the aforementioned currency notes would be withdrawn with immediate effect. The government also announced the introduction of new INR 500 and INR 2000. A number of regulations and restrictions were placed on the people of India in reference to cash withdrawal from bank accounts and exchange of demonetized notes causing widespread anguish. Now, a year hence, with adequate cash having been infused into the economy, let us take an objective look at the demonetisation drive and the developments that followed.

It has been exactly one year since Prime Minister Narendra Modi launched what has been decreed India’s greatest offensive against black money – the demonetisation of INR 500 (old) and INR 1000 notes. Delivered a bolt from the blue, the PM addressed the nation on Friday (8 November, 2016) at about 8 pm and said that the aforementioned currency notes would be withdrawn with immediate effect. The government also announced the introduction of new INR 500 and INR 2000. A number of regulations and restrictions were placed on the people of India in reference to cash withdrawal from bank accounts and exchange of demonetized notes causing widespread anguish. Now, a year hence, with adequate cash having been infused into the economy, let us take an objective look at the demonetisation drive and the developments that followed.

Demonetisation Woes

The demonetisation caused much discomfort and misery to the common man – that much is undeniable. Through most of November (after the demonetisation was announced) a maximum cash withdrawal limit of INR 4000 was announced. Exchange of demonetized currency before 31 December resulted in endless queues outside banks and post offices. All 2,05,509 ATMs in the country were initially shut down and even after recalibration a maximum of INR 2000 could be withdrawn on a single day. Numerous tales of people falling ill and even dying in the queues were reported but the worst hit were daily laborer and people from the lower rungs of the economy who depend largely on cash payments. Handloom, consumer goods, jewellery, auto, and paints were some of the severely affected sectors that suffered from lack of liquidity. Small companies which traditionally record an earning between INR 250 million and INR 500 million on an annual basis were severely impacted. Year-on-year sales in these companies went from -19.3 percent in FY 2015-16 to -53.6 percent in FY 2016-17. The common man silently suffered through the demonetisation drive in the hope that black money would be flushed out through this exercise and this will bring long term benefits to the country.

Government Promotes Digital Payments

The greatest positive outcome of the demonetisation exercise undertaken by the GoI was the boost it imparted to digital payments, taking the nation closer towards becoming a cashless economy. In December 2016, PM Modi launched the BHIM (Bharat Interface for Money) app – an indigenous mobile payment application based on UPI (Universal Payments Interface). The application allows smartphone users to link their bank accounts and make payments through UPI. Over 30 leading public sector banks and private banks can be connected with BHIM. The government also incentivized the use of BHIM by announcing the Digi-Dhan Vyapar Yojna and the Lucky Grahak Yojna. By February this year, BHIM was downloaded 17 million times setting a record.

Spike in Cashless Transactions

UPI based BHIM certainly made its mark with the masses, more so because it allowed payments to non UPI based recipients and also because it did not require an active internet connection for the payments to be made. In urban regions, however, the use of mobile wallets such as PayTM, Google Tez, Airtel Money, Citrus Pay and Freecharge began to rule the roost. From the local vegetable vendor to cabs on hire, everyone seemed more than willing to accept digital payments. This is a temporary phenomenon, said critics of the government but statistics reveal a different story. About a year after the announcement of demonetisation, the people remained keen on conducting digital transactions. Some 68 million UPI transactions were conducted across India in October 2017 – a massive increase from the 0.3 million in November 2016. 82 million MPS transactions were conducted in October 2017, up from 36 million in November last year. Integration is now king and a number of private digital wallets such as PayTM have linked with BHIM and its UPI based interface. Not wanting to be left behind, public sector banks in India too have been actively promoting their mobile banking apps and e-wallets over the past year. SBI Pay by SBI, Axis Pay by Axis Bank, eMpower by Canara Bank and PayZapp by HDFC are among the most used mobile wallets (by Indian banks). The launch of India Post Payments Bank (IPPB) is another major development aimed at capitalizing the vast outreach of India Post and promoting digital payments. There remains much debate about the quantity of black money flushed out by the demonetisation drive. There are numerous lessons in policy implementation that our government may wish to take but one thing remains clear. The exercise has ushered in a new era of digital payments and cashless transactions.