Planning for retirement should be a key part of everyone’s financial strategy, no matter their current stage of life. Even if retirement seems far off, taking initial steps like beginning to save and invest can help secure future well-being and peace of mind. Starting the retirement planning process early allows time for savings and investments to grow, helping individuals achieve the comfortable lifestyle they envision for their later years. Proper preparation for this important life transition can help reduce stress and provide welcome financial security in the coming years.

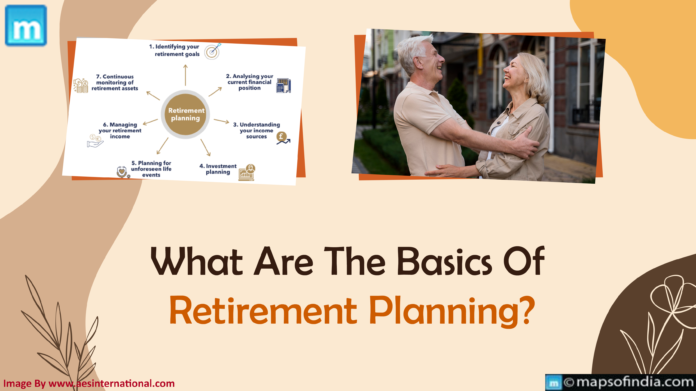

Here are some essential steps to understand the basics of retirement planning:

-

Set clear goals

When planning for retirement, it’s important to think about what you want your retirement to look like. Think about things like how old you want to be when you stop working, what you want to do daily, and any hobbies you enjoy. Having a clear picture of your goals will help you figure out how much money to save and how to use your money best. Knowing what you want your retirement to be will guide you in preparing for it.

-

Calculate Retirement Expenses

Think about how much money you will need during retirement. Look at what you spend now on housing, food, medical costs, and fun activities. Retirement expenses may be different, so adjust as needed. Make sure to include all the important costs of living. It’s important to be realistic about how much you will spend when you stop working. That way, you know how much to save to have enough money to pay for your retirement.

-

Evaluate sources of Retirement Income

Think about where your retirement money will come from. This includes savings from a 401k at work, money from Social Security, personal savings in bank accounts, and investment returns. Learn how each type of income works and how much you’ll get from each source when you retire. Knowing this will help you determine if you need to save more now or find other ways to make money later in life. Figuring out your sources of retirement income is important to know if you have enough to live on.

-

Maximise Employer Benefits

If your job offers a retirement savings plan like a 401k, contribute as much as possible. Many employers will add extra money to your account if you save a certain amount. That’s like getting free money to save for retirement. Save at least enough to get that matching money from your employer. It’s an easy way to increase your retirement funds. Also, think about other plans at work that can help pay medical costs later, like health savings accounts. Using all the benefits from your job is smart for saving for the future.

-

Save Consistently

Begin saving for retirement while you’re young. Make saving a regular part of your routine, even if it’s just a little bit each time. The earlier you start, the more your money can grow over many years. When you let your savings grow on top of what you already saved, it adds up faster. Set it up so saving happens automatically – like having part of each paycheck put directly into your retirement fund. If you start saving early and keep it up consistently, you’ll have more money saved by the time you stop working.

-

Invest wisely

Make a plan for investing your retirement savings based on how comfortable you are with risk, how long until retirement, and what you want your money to do for you. Don’t put all your eggs in one basket – spread your savings across different investments. This helps your money grow better while lowering the chance of losing a lot if one investment does poorly. Talking to a professional financial advisor can help you make an investment strategy just right for your situation and goals. They can help you decide the best places to put your retirement money.

-

Review and adjust regularly

Check in on your retirement savings plan often. Ensure you’re still on track to meet your goals when you stop working. Watch how much you’ve saved and how your investments are doing. Things in your life and the economy may change, so you may need to adjust how much you put away or where your money is invested. Stay flexible so you can modify your plan as needed. It’s important to keep reviewing your savings strategy over the years to keep your retirement funds growing in the right direction.

In summary, planning for retirement is really important for your financial health. You need to think about goals, how much things will cost, where money will come from, save regularly, and invest smartly. Check your plan often, too. Doing all this will set you up well for a good retirement. Start getting ready for retirement now so you can enjoy your future.