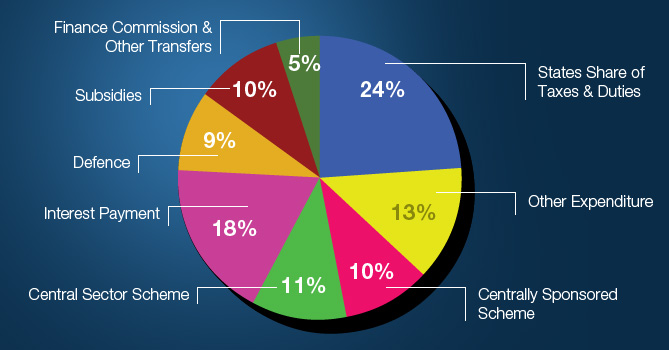

On February 1, 2017, shortly after the Union Budget speech ended in the parliament, the Finance Ministry shared a tweet with a pie chart that showed how the government spends the public funds. According to the estimates put forth by the ministry, for each Rupee of public fund (major income being income from the various taxes), 24 paise is given to the various states as their share of the taxes and duties. The next greatest expense is payment of interest which is pegged at 18 paise.

Central sectoral schemes take up about 11 paise while various subsidies and centrally sponsored schemes cost 10 paise each. The defence allocation for every rupee is about 9 paise and transfers (including Finance Commission) take up about 5 paise. All other expenses together claim 13 paise.

Now let us look at each of these heads individually.

State’s Share of Taxes

In 2015-16 the government of India earned about Rs 14.6 lakh crore by way of taxes. This income from taxes was the highest revenue for the government in any given fiscal year. We often hear about the “tax payer’s money”; however, this is not only income tax paid by individuals but also includes corporate taxes, customs and excise duty, service taxes, property and entertainment tax.

In his budget speech, Finance Minister (FM) Arun Jaitley declared that about Rs 5.53 lakh crore worth of direct taxes were collected in the first three quarters of 2016-17 and Rs 6.30 lakh crore worth of indirect taxes were collected for this period. Of these, some taxes such as corporate tax, customs duties, etc are retained by the centre and taxes such as stamp duties and estate duty on property, etc are paid by the centre to the states. This amount comes up to about 24 percent of the central government’s expenditure according to the allocation shown.

Payment of Interest

When we take a loan to purchase an asset or to meet any expenditure that we may incur, we are required to pay an interest on such a loan. Similarly, the government also is required to pay an interest on its borrowings. According to a report presented by the FM last year, India’s external debt stood at US$485.6 billion by end March 2016 (a rise of US$10.6 billion from March 2015).

Apart from this, the government has a sizeable amount of internal debt that has been raised by issuance of government bonds, etc. The interest that the government pays on these debts stands at 18 percent of the total expenditure from public funds. Some economists hold that this is a high figure and that the government must work hard to manage its debt situation. The volatility of the rupee vis-a-vis the US Dollar makes things worse for the government because this means that we pay more by way of interest and repayment with every fall in the Rupee value.

Defence Spends

One of the much awaited announcements made by the FM each year in his budget speech is the allocation or the expenditure planned towards the defence sector. Yesterday, FM Jaitley said that for FY 2017-18, the defence budget would be pegged at Rs 2.74 lakh crore. This is a mere six percent hike from Rs 2.58 lakh crore allocated last year. While overall the budget has been a popular one, the allocation for defence has come across as inadequate and has cause much angst among the defence personnel in the country.

Defence expenditure still remains a low priority for the Indian government. In fact, a six percent hike is no hike at all, if we stop to consider the effects of inflation and the newly introduced customs duty on all military imports.

Alarming reports have surfaced suggesting that the ammunitions held by the Army are inadequate to see us through a military campaign. Despite this fact the government is reluctant to make any major imports. Another point to consider is that the defence budget is 1.62 percent of the GDP (it was 1.5 percent of the GDP in 1962).

Most expert panels have recommended that this be raised to 2.5 percent of the GDP. If fact, according to the statistics presented by the Finance Ministry, the government spends nine percent of public money on defence, while 11 percent on Central sector schemes and an additional 10 percent on centrally sponsored schemes.

Government Subsidies

Each year in the budget, the government announces subsidies, i.e. money that it pays to public undertakings or corporates for selling goods and services at a cheaper rate. Traditionally, food subsidies (popularly called “ration”), kerosene and LPG subsidies, fertilizer subsidies make up a great deal of the government’s expenditure. According to the chart shared, the government spends 10 percent on these subsidies.

One of the strongest recommendations made to the government in recent years is to cap the subsidy burden to one percent of the GDP and to reduce the fertilizer subsidy as well.

Schemes And More

Centrally Sponsored Schemes (CSS) claim about 10 percent of the expenditure. It refers to schemes that are implemented by the state government but are funded by the central government. One of the important CSS that found a mention in FM’s budget speech yesterday was the Pradhan Mantri Gram Sadak Yojna for which he allocated Rs 19,000 crore. Other projects such as construction of river dams are often funded under the CSS. They claim 10 percent of the central expenditure while central government schemes themselves come to 11 percent of the total spends.

Pie Chart of Expenses

It is commendable that the Ministry of Finance has come clean with its expenditure on a public forum like Twitter. This year’s budget too, seemed to be an accounting exercise – another great effort in transparency and accountability. A closer look, however, reveals the areas that need the FM’s attention.

Defence is not getting enough focus and spending on schemes need to be curbed. Interests are high indicating that there is too much borrowing or that the loans are expensive and alternatives need to be looked at. We are also sure that Indians would like to take a closer look at the “Other Expenses” that claim 13 paise to every rupee spent.

This is the first step at true financial democracy and we hope it helps the government receive constructive suggestions for the fiscal prosperity of the country.

Read More on Union Budget 2017…

Implications on Agricultural Sector