The Prime Minister Narendra Modi launched the promised Micro Units Development and Refinance Agency Ltd (MUDRA) Bank on 8 April, 2015 with a corpus of Rs 20,000 crore and a credit guarantee corpus of Rs 3,000 crore. The launch was the fulfillment of an announcement made earlier by the Finance Minister Arun Jaitley in his FY 15-16 Budget speech.

The Prime Minister Narendra Modi launched the promised Micro Units Development and Refinance Agency Ltd (MUDRA) Bank on 8 April, 2015 with a corpus of Rs 20,000 crore and a credit guarantee corpus of Rs 3,000 crore. The launch was the fulfillment of an announcement made earlier by the Finance Minister Arun Jaitley in his FY 15-16 Budget speech.

How Can MUDRA Bank Make a Difference to the Economy?

Most individuals, especially those living in rural and interior parts of India, have been excluded from the benefits of formal banking system. Therefore, they never had access to insurance, credit, loans and other financial instruments to help them establish and grow their micro businesses. So, most individuals depend on local money lenders for credit. The loan comes at high interest and often with unbearable conditions, which make these poor unsuspecting people fall in a debt-trap for generations. When businesses fail, the borrowers become vulnerable to the lender’s strong-arm tactics and other forms of humiliation.

As per NSSO Survey of 2013, there are close to 5.77 crore small-scale business units, mostly sole proprietorships, which undertake trading, manufacturing, retail and other small-scale activities. Compare this with the organised sector and larger companies that employ 1.25 crore individuals. Clearly, the potential to harness and nurture these micro businesses is vast and the government recognises this. Today, this segment is unregulated and without financial support or cover from the organised financial banking system.

The principal objectives of the MUDRA Bank are:

- Regulate the lender and the borrower of microfinance and bring stability to the microfinance system through regulation and inclusive participation.

- Extend finance and credit support to Microfinance Institutions (MFI) and agencies that lend money to small businesses, retailers, self-help groups and individuals.

- Register all MFIs and introduce a system of performance rating and accreditation for the first time. This will help last-mile borrowers of finance to evaluate and approach the MFI that meets their requirement best and whose past record is most satisfactory. This will also introduce an element of competitiveness among the MFIs. The ultimate beneficiary will be the borrower.

- Provide structured guidelines for the borrowers to follow to avoid failure of business or take corrective steps in time. MUDRA will help in laying down guidelines or acceptable procedures to be followed by the lenders to recover money in cases of default.

- Develop the standardised covenants that will form the backbone of the last-mile business in future.

- Offer a Credit Guarantee scheme for providing guarantees to loans being offered to micro businesses.

- Introduce appropriate technologies to assist in the process of efficient lending, borrowing and monitoring of distributed capital.

- Build a suitable framework under the Pradhan Mantri MUDRA Yojana for developing an efficient last-mile credit delivery system to small and micro businesses.

Major Product Offerings

MUDRA Bank has rightly classified the borrowers into three segments: the starters, the mid-stage finance seekers and the next level growth seekers.

To address the three segments, MUDRA Bank has launched three Mudra loan instruments:

- Shishu: covers loans upto Rs 50,000/-

- Kishor: covers loans above Rs 50,000/- and upto Rs 5 lakh

- Tarun: covers loans above Rs 5 lakh and upto Rs 10 lakh

Initially, sector-specific schemes will be confined to “Land Transport, Community, Social & Personal Services, Food Product and Textile Product sectors”. Over a period of time, new schemes will be launched to encompass more sectors.

MUDRA operates as a refinancing institution through State/Regional level intermediaries. It refinances NBFCs/MFIs and also banks, primary lending institutions etc.

Some of the Offerings Planned for the Future:

- MUDRA Card

- Portfolio Credit Guarantee

- Credit Enhancement

Mudra Loan Mela

The government is organising MUDRA loan melas in different parts of the country. These melas are organised for few days where loans for small business funding could be applied. In the melas, loans are granted ranging from Rs. 50,000 to Rs. 10 lakh.

To know more about the process of loan you can contact the Nodal officer of your area. http://www.mudra.org.in/Nodal-Officers-MUDRA.pdf

Can MUDRA Really Be a Game Changer for India?

Yes it can. See the existing demographics. Majority of Indians are poor and live in rural and interior parts of India. Most are excluded from getting facilities that would be termed very basic, even by Indian standards.

Most people do not have access to farmland and in the absence of jobs, are left to their own creativity to feed themselves and survive. They figure out ways to do odd jobs in exchange of money or barter their services. Most of these people belong to scheduled castes, scheduled tribes and other backward classes. It is to be noted that most of the micro enterprises, retail or trading activity, are initiated and controlled by women, with no exposure to education, formal training or access to any form of banking support.

Now visualise this. If India could harness this free spirit of enterprise and offer some guidance, support, training and financial assistance, the potential to get an immediate jump in GDP is there for the asking. Narendra Modi recognises this and was clear of the potential of this low-hanging fruit.

If MUDRA can continue to retain focus on the underprivileged and extend its reach to the interiors, it can well emerge as a bigger success story than what Grameen Bank of Bangladesh ever was or will be.

There is an old saying that goes like this: “Give a man a fish you feed him for a day, teach him how to fish and he will never go hungry”. MUDRA Bank is a step by the government that can be a game changer in giving birth to a new set of entrepreneurs, some of whom may scale heights not imagined today. This is far better than giving subsidy, which may seem welcoming at first, but does little to help an individual strive for a better life. MUDRA is the way to go.

The modalities of functioning of MUDRA Bank are in place and it has been decided that the funding activity will be carried out by microfinance institutions. However, the small businesses have to wait to get full information on Mudra Bank and have a clarity on who all are eligible for MUDRA loans and how to get the benefits of this scheme.

MUDRA Bank Contact Details:

| Registered OfficeSidbi, ground floor, Videocon Tower,Jhandewalan Extension,E-1, Rani Jhansi Road,New Delhi – 110055 | Corporate OfficeMSME Development Centre,C-11, g-block, Bandra Kurla Complex,Bandra East, Mumbai – 400 051 |

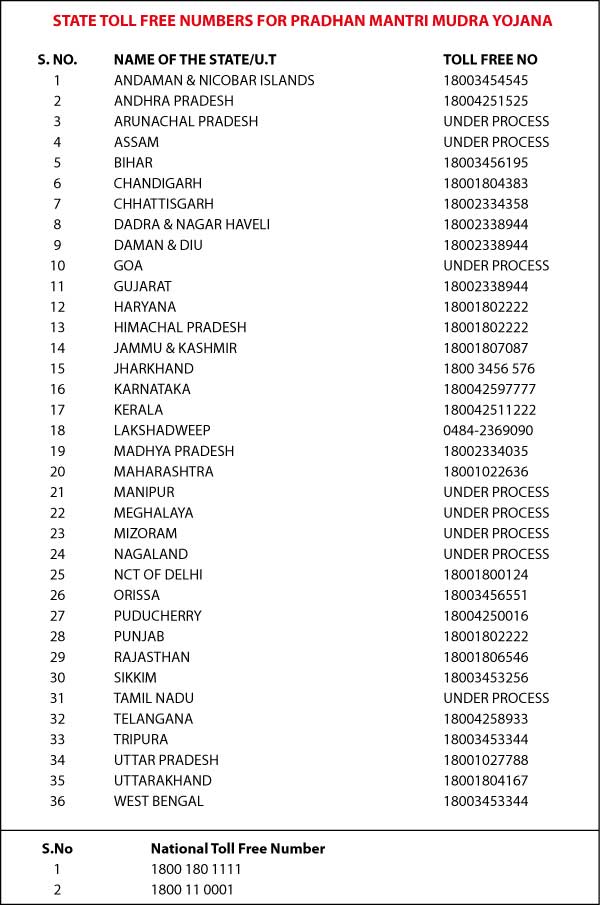

Mudra Bank Toll Free Numbers

Contact list of MUDRA officers:

http://www.mudra.org.in/ContactUs

Eligibility Criteria / Documents required for MUDRA Loan

1. Proof of identity – Self certified copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card/Passport.

2. Proof of residence – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors.

3. Proof of SC/ST/OBC/Minority.

4. Proof of Identity/Address of the Business Enterprise -Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit.

5. Applicant should not be defaulter in any Bank/Financial institution.

6. Statement of accounts (for the last six months), from the existing banker, if any.

7. Last two years balance sheets of the units along with income tax/sales tax return etc. (Applicable for all cases from Rs.2 Lacs and above).

8. Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (Applicable for all cases from Rs.2 Lacs and above).

9. Sales achieved during the current financial year up to the date of submission of application.

10. Project report (for the proposed project) containing details of technical & economic viability.

11. Memorandum and articles of association of the company/Partnership Deed of Partners etc.

12. In absence of third party guarantee, Asset & Liability statement from the borrower including Directors& Partners may be sought to know the net-worth.

13. Photographs (two copies) of Proprietor/ Partners/ Directors.

Recent Developments

- On 4 July, the Corporation Bank launched the first MUDRA card under the Pradhan Mantri Mudra Yojana (PMMY).

- On 1 July, IDBI aigned an agreement with MUDRA for refinancing of loans.

- Hasmukh Adhia, union financial service secretary said that Mudra Bank will be first set up as a subsidiary of the Small Industries Development Bank of India and later will be converted to a full-fledged bank through an Act of Parliament. Adhia made this announcement during a ‘roundtable on financing of innovations’ which was attended by chiefs of banks and financial institutions, and also the President of India. Although Adhia did not disclose the details about the set up of Mudra Bank, he said that the Prime Minister will launch it soon.

- MUDRA bank has join hands with 19 state and regional level coordinators so as to reach the small entrepreneurs who have limited branch presence and are cut off from the general banking system. The initiative taken by the government is expected to be helpful for the small and micro businesses. It is also expected that these businesses will generate 10 times more number of jobs which are normally generated by the big business firms/companies at present.

- Mudra Bank has roped in the services of i-exceed’s Appzillon app to extend the scope of their banking services across mobile platforms. Appzillon is an all-channel application development platform to support organisations in their digital initiatives.

- MUDRA Bank chief executive Jiji Mammen has said that banks are expected to infuse Rs 1.80 lakh crore as loans under Micro Units Development and Refinance Agency (MUDRA) Bank Yojana during the 2016-17 fiscal.

- The government has surpassed its target of giving MUDRA loans of up to Rs 1.22 lakh crore through Mudra Bank and it has set a new target of Rs 1.8 lakh crore for the 2016-17 financial year.

- An eight member RBI expert committee on MSMEs on June 18, 2019 has recommended doubling the cap on collateral-free loans to Rs 20 lakh from the current Rs 10 lakh. This will be extended to borrowers falling under the Mudra scheme, self-help groups, and MSMEs.

For further information on Mudra Bank, please log onto: http://www.mudra.org.in

Click here to view Pradhan Mantri MUDRA Yojana in Hindi – मुद्रा बैंक

Read More

Schemes Launched by Modi Govt

IDFC Bank

Start-up India, Stand-up India

Gram Uday Se Bharat Uday Abhiyan

‘Stand up India’ Scheme by PM Modi : Highlights, Objectives, Benefits, Process

Bandhan Bank

Pradhan Mantri Ujjwala Yojana

Atal Pension Yojana

Sukanya Samriddhi Account

Swachh Bharat Abhiyan: Making India Clean & More

National LED Programme

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Pradhan Mantri Kaushal Vikas Yojana

Pradhan Mantri Krishi Sinchai Yojana

Pradhan Mantri Awas Yojana (PMAY)

One Rank One Pension Scheme

Seventh Pay Commission

Garib Kalyan Yojana

Integrated Power Development Scheme (IPDS)

All Information about Digital India Programme

DigiLocker

eBasta – Features and Benefit for students

Atal Mission for Rejuvenation and Urban Transformation

Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

Beti Bachao Beti Padhao Scheme

Pahal Scheme

Jan Dhan Yojana

Skill India

Pradhan Mantri Fasal Bima Yojana (PMFBY)