Chapter 5 – Aggregate Demand and Its Related Concepts Questions and Answers: NCERT Solutions for Class 12 Economics

Class 12 Economics chapter 5 - Aggregate Demand and Its Related Concepts - Questions and Answers of NCERT Book Solutions.

Question 1. What is marginal propensity to consume? How is it related to marginal propensity to save?

Answer: (i) The ratio of change in consumption (C) to change in income (Y) is known as marginal propensity to consume. It indicates the proportion of additional income that is being spent on consumption.

MPC=ΔCΔY

The sum of MPC and MPS is equal to one. It can be proved as under: We know: ΔY = ΔC + ΔS Dividing both sides by AY, we get,ΔY/ΔY=ΔC/ΔY + ΔS/ΔY or 1=MPC+MPS

[ΔY/ΔY=1; ΔC/ΔY =MPC ΔS/ΔY=MPS]

MPC + MPS = 1 because total increment in income is either used for consumption or for saving.

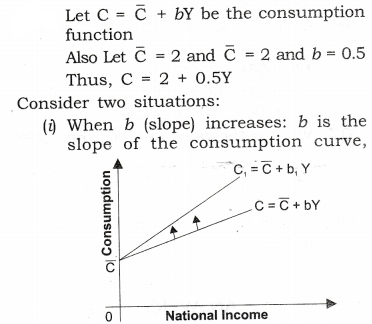

Question 2. What do you understand by ‘para¬metric shift of a line’? How does a line shift when its (i) slope increases and (ii) its intercept increases?

Answer: (i)

when b increases from 0.5 to 0.75, then consumption curve (which is a straight line) pivots upwards. This is called a parametric shift of a graph. It is shown in figure.

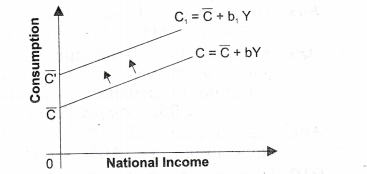

(ii)When C increases: It is the autonomous part of the consumption function. It graphically gives the intercept of the consumption curve. If increases from 2 to 5, there will be parallel upward shift in the consumption curves. It is shown in figure given.

Thus, when slope changes, there is parametric shift in the curve. When intercept changes, there is parallel shift in the curve.

I.Very Short Answer Type Questions

Question 1. What is Aggregate demand in Macroeconomics?

Answer: It is aggregate expenditure on ex-ante (planned) consumption and ex-ante (planned) investment that all sectors of the economy are willing to incur at each income level.

Question 2. What is Aggregate Supply in Macroeconomics?

Answer: Aggregate supply is the total amount of money value of goods and services, (which is paid to the factor of production against their factor services) that all the producers are willing to supply in an economy.

Question 3. What is consumption function?

Answer: Consumption function expresses functional relationship between aggregate consumption and national income.

Question 4. Can the value of APC be less than zero?

Answer: No, because even at the zero level of income, we will consume something i.e., autonomous consumption.

Question 5. Why can value of MPC be not greater than one?

Answer: It is so because Keynes’ psychological law of consumption states that when income increases, consumption also increases but at a lesser rate. So, increase in consumption is always less than increase in income, i.e., MPC=ΔC/ΔY is always less than one.

Question 6. Can the value of average propensity to save be negative? If yes,when?

Answer: Yes, the value of average propensity to save can be negative when consumption is more than national income, i.e., before the break-even point.

Question 7. What can be the maximum value of marginal propensity to save?

Answer: The maximum value of marginal propensity to save is 1. It is only possible when MPC = 0, i.e., the entire additional income is saved.

Question 8. What is the relationship between APC and APS?

Answer: The sum of APC and APS is equal to one, i.e., APC + APS = 1.

Question 9. What is the relationship between marginal propensity to save and marginal propensity to consume?

Answer: The sum total of MPC and MPS is equal to one, i.e., MPC + MPS = 1.

Question 10. Give the meaning of autonomous consumption.

Answer: It refers to minimum level of consumption (i.e., C) , which is needed for survival, i.e., consumption at zero level of national income.

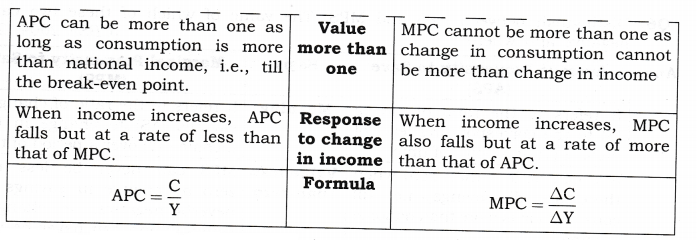

Question 11. Let the consumption be C = 50 + 0.75 Y, then calculate saving function?

Answer: As we know that

S = Y – C = Y -(50 + 0.75 Y)

– Y – 50 – 0.75Y

S = -50 + Y(l-0.75) = -50 + 0.25Y

II. Short Answer Type Questions

Question 1. Explain the components of aggregate demand.

Or

State components of AD. Describe any one.

Answer: The components of aggregate demand are:

1. Private (or Household) consumption demand

(a) The total expenditure incurred by all the households of the countiy on their personal consumption is known as private consumption expenditure.

(b) Consumption demand depends mainly on disposable income and propensity to consume.

2. Private investment demand

(a) Private investment demand refers to the demand for capital goods by private investors.

(b) It is addition to the existing stock of real capital assets such as machines, tools, factory-building etc.

(c) Investments demand depends upon marginal efficiency of capital (Marginal efficiency of investment) and interest rate.

(d) Investment is of two types, Autonomous Investment and Induced investment, but in Keynes theory investment assumed to be Autonomous.

3. Government demand for goods and services

(a) In a modem economy, the government is an important buyer of goods and services.

(b) The government demand may be on account of public needs for roads, schools, hospitals, power, irrigation etc, for the maintenance of law and order and for defence.

4. Demand for net export (X – M)

(a) Net export represents foreign demand for goods and services produced by an economy.

(b) When exports exceed imports, net exports is positive and when imports exceed, net exports is negative.

(c) Exports and imports of a country are influenced by a number of factors such as foreign trade policy, exchange- rate, prices and quality of goods etc.

Thus, aggregate demand consists of these four types of demand.

AD = C + I + G + (X – M)

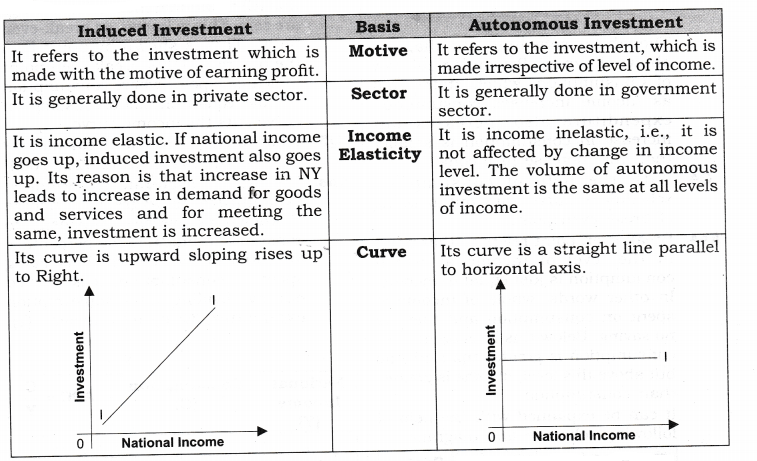

Question 2. Explain the distinction between ‘autor mous investment’ and “induced investment’.

Answer:

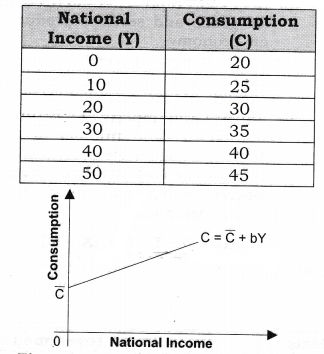

Question 3. Briefly state the concept of consumption function. Explain with schedule and diagram.

Answer: (i) Consumption function expresses functional relationship between aggregate consumption and national income. Thus, consumption (C) is a function of income (Y).

C = F (Y)

Where,

C = Consumption

F = Function

Y = Disposable income

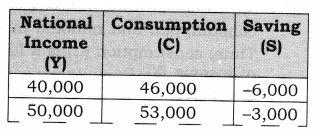

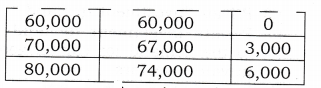

(ii) It can be explained with the help of the following schedule and diagram:

The above schedule and diagram shows Keynes’ Psychological law of Consumption, which states that as income increases consumption expenditure also increases but increase in consumption is smaller than the increase in income.

Question 4. With the help of consumption schedule or curve bring out meaning of break-even point.

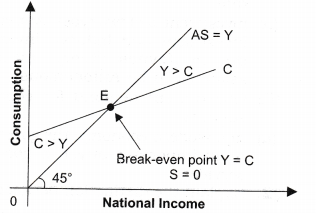

Answer: Break-even point refers to that point in the level of income at which consumption is just equal to income. In other words, whole of income is spent on consumption and there is no saving. Below this level of income, consumption is greater than income but above this level, income is greater than consumption.

It can be explained with the help of following schedule and diagram:

In the above imaginary house hole schedule of consumption and saving, at annual income level of Rs 60,000, consumption is Rs 60,000 and in consequence there is no saving. This is break-even point.

In the above diagram, when Consumption (C) = National Income(Y), savings are zero. This is known as break-even point. This is shown by point E in the diagram. Thus break even point indicates a point where consumption becomes equal to income or consumption curve cuts the income curve.

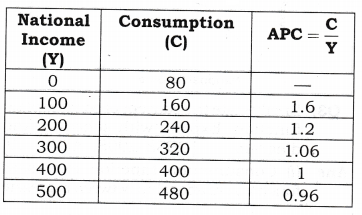

Question 5. What is APC? How is it calculated?

Answer: The ratio of aggregate consumption expenditure to aggregate income is known as average propensity to consume. It indicates the percentage (or ratio) of income which is being spent on consumption. It is worked out by dividing total consumption expenditure (C) by total income (Y). APC=C/Y

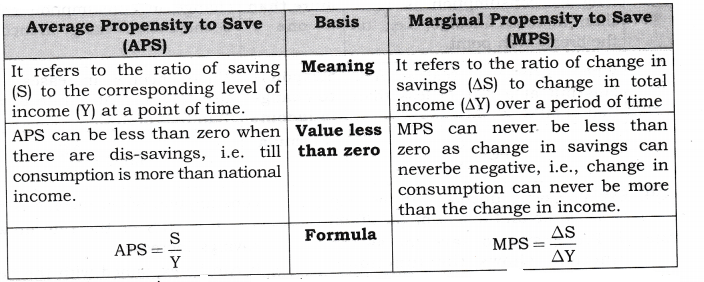

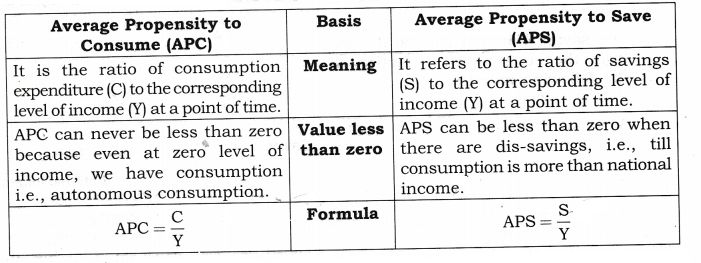

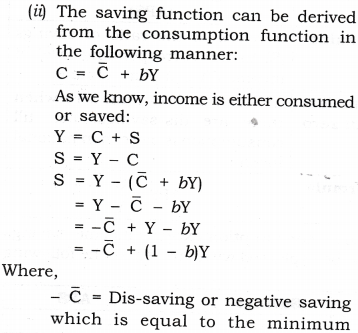

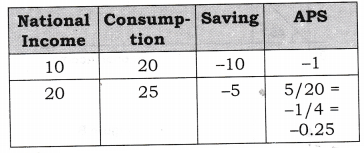

Question 6. Distinguish between APS and MPS. The value of which of these two can be negative and when?

Answer:

APS can be negative, when at low level of income consumption exceeds income, savings are negative which make the APS negative. It can be explained with the help of the following schedule:

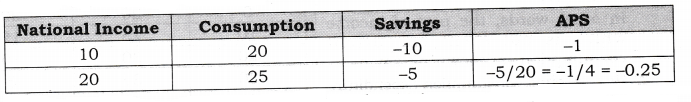

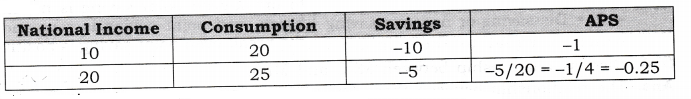

Question 7. Differentiate between APC and APS and tell which of them is negative.

Answer:

APS can be negative. When at low level of income consumption exceeds income, savings are negative and make the APS negative. It can be explained with the help of the following schedule.

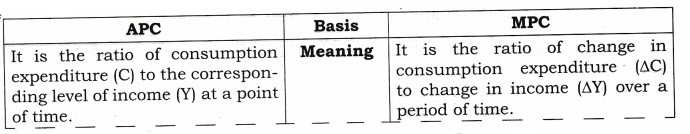

Question 8. Differentiate between APC and MPC.

Answer:

Question 9. Explain saving function with the help of schedule and diagram.

Answer: (i) Propensity to save (or saving function) shows the functional relationship between aggregate savings and income.S=f(Y) In other words, the part of income which is not spent on current consumption is known as saving. By deducting consumption expenditure (C) from income (Y), we get saving (S). S = Y – C

lll.True Or False

Question 1. Average propensity to save is always greater than zero.

Answer: False. Because at very low level of income, when consumption exceeds income, then saving becomes negative and APS < 0. It can be explained with the help of the following schedule:

Question 2. Value of average propensity to save can never be less than zero.

Answer: False. The value of APS can be less than zero (i.e., negative). When consumption expenditure (C) becomes greater than income then the volume of savings becomes negative. Hence APS will be negative, (i.e., less than zero). This is shown as;

Let C = 1500 and Y = 1,000.

We know, S = Y – C = 1,000 – 1500 = -500

APS=S/Y = -500/1000 =(-)0.5

Thus, the value of APS can be less than zero (i.e. negative).

Question 3. When the value of average propensity to save is negative, the value of marginal propensity to save will also be negative.

Answer: False. Value of APS has no relationship with MPS. APS is closely related with APC, i.e., APS + APC = 1. When APC is greater than unity (as in case of lower level of income), the value of APS is negative.

Question 4. The value of marginal propensity to save can never be negative.

Answer: True. MPS can never be less than zero as change in savings can never be negative, i.e., change in consumption can never be more than the change in income.

Question 5. The value of average propensity to save can never be greater than 1.

Answer: True because Saving can never be greater than Income.

Question 6. Sum of average propensity to consume and marginal propensity to consume is always equal to 1.

Answer: False. The value of APC has no relationship with MPC. Either APC + APS = 1 or MPC + MPS = 1

Question 7. If income is Rs 10,000 crore and consumption is Rs 5,000 crore, APC would be 0.5.

Answer: True.As,APC=C/Y =5000/10000 =0.5

Last Updated on: January 14, 2026