CBSE Class 12th Accountancy Sample Question Papers with Answer Key/Solution

CBSE 2021-22, Class 12 Accountancy board exam sample question paper. Check the answers key or solution of the class 12 Accountancy (Term 1) paper.

SECTION A

Instructions:

From question number 1 to 18, attempt any 15 questions.

1. Gain / loss on revaluation at the time of change in profit sharing ratio of existing partners is shared by ___(i)______ whereas in case of admission of a partner it is shared by____(ii)_____.

- (i) Remaining Partners, (ii) All Partners.

- (i) All Partners, (ii) Old partners.

- (i) New Partner, (ii) All partner.

- (i) Sacrificing Partner, (ii) Incoming partner.

The correct answer is (i) All Partners, (ii) Old partners.

2. Calculate the amount of second & final call when Abhijit Ltd, issues Equity shares of ₹10 each at a premium of 40% payable on Application ₹3, On Allotment ₹5, On First Call ₹2.

- Second & final call ₹3.

- Second & final call ₹4.

- Second & final call ₹1.

- Second & final call ₹14.

The correct answer is Second & final call ₹4.

3. Anish Ltd, issued a prospectus inviting applications for 2,000 shares. Applications were received for 3,000 shares and pro- rata allotment was made to the applicants of 2,400 shares. If Dhruv has been allotted 40 shares, how many shares he must have applied for?

- 40

- 44

- 48

- 52

The correct answer is 48

4. Ambrish Ltd offered 2,00,000 Equity Shares of ₹10 each, of these 1,98,000 shares were subscribed. The amount was payable as ₹3 on application, ₹4 an allotment and balance on first call. If a shareholder holding 3,000 shares has defaulted on first call, what is the amount of money received on first call?

- ₹9,000

- ₹5,85,000

- ₹5,91,000

- ₹6,09,000

The correct answer is ₹5,85,000.

5. What will be the correct sequence of events? (i) Forfeiture of shares (ii) Default on Calls. (iii) Re-issue of shares (iv) Amount transferred to capital reserve. Options:

- (i), (iv), (ii), (iii)

- (ii), (iv), (i), (iii)

- (ii), (i), (iii), (iv)

- (iii), (iv), (i) (ii)

The correct answer is (ii), (i), (iii), (iv)

6. Arun and Vijay are partners in a firm sharing profits and losses in the ratio of 5:1.

Balance Sheet (Extract)

| Liabilities | ₹ | Assets | ₹ |

| Machinery | 40000 |

If the value of machinery reflected in the balance sheet is overvalued by 33 %, find out the value of Machinery to be shown in the new Balance Sheet:

- ₹ 44,000

- ₹48,000

- ₹ 32,000

- ₹30,000

The correct answer is ₹30,000

7. Which of the following is true regarding Salary to a partner when the firm maintains fluctuating capital accounts?

- Debit Partner’s Loan A/c and Credit P & L Appropriation A/c.

- Debit P & L A/c and Credit Partner’s Capital A/c.

- Debit P & L Appropriation A/c and Credit Partner’s Current A/c.

- Debit P & L Appropriation A/c and Credit Partner’s Capital A/c.

The correct answer is Debit P & L Appropriation A/c and Credit Partner’s Capital A/c.

8. At the time of reconstitution of a partnership firm, recording of an unrecorded liability will lead to:

- Gain to the existing partners

- Loss to the existing partners

- Neither gain nor loss to the existing partners

- None of the above

The correct answer is None of the above

9. E, F and G are partners sharing profits in the ratio of 3:3:2. According to the partnership agreement, G is to get a minimum amount of ₹80,000 as his share of profits every year and any deficiency on this account is to be personally borne by E. The net profit for the year ended 31st March 2021 amounted to ₹3,12 ,000. Calculate the amount of deficiency to be borne by E?

- ₹1,000

- ₹4,000

- ₹8,000

- ₹2,000

The correct answer is ₹2,000

10. At the time of admission of a partner, what will be the effect of the

following information?

Balance in Workmen compensation reserve ₹40,000. Claim for

workmen compensation ₹45,000.

- ₹45,000 Debited to the Partner’s capital Accounts.

- ₹40,000 Debited to Revaluation Account.

- ₹5,000 Debited to Revaluation Account.

- ₹5,000 Credited to Revaluation Account.

The correct answer is ₹5,000 Debited to Revaluation Account.

11. In the absence of partnership deed, a partner is entitled to an interest on the amount of additional capital advanced by him to the firm at a rate of:

- entitled for 6% p.a. on their additional capital, only when there are profits.

- entitled for 10% p.a. on their additional capital

- entitled for 12% p.a. on their additional capital

- not entitled for any interest on their additional capitals.

The correct answer is not entitled for any interest on their additional capitals.

12. Revaluation of assets at the time of reconstitution is necessary because their present value may be different from their:

- Market Value.

- Net Value.

- Cost of Asset

- Book Value.

The correct answer is Market Value.

13. If average capital employed in a firm is ₹8,00,000, average of actual profits is ₹1,80,000 and normal rate of return is10%, then value of goodwill as per capitalization of average profits is:

- ₹10,00,000

- ₹18,00,000

- ₹80,00,000

- ₹78,20,000

The correct answer is ₹10,00,000

14. In which of the following situation Companies Act 2013 allows for issue of shares at discount?

- Issued to vendors.

- Issued to public.

- Issued as sweat equity.

- None of the above.

The correct answer is Issued as sweat equity.

15. As per Section 52 of Companies Act 2013, Securities Premium Reserve cannot be utilised for:

- Writing off capital losses.

- Issue of fully paid bonus shares.

- Writing off discount on issue of securities.

- Writing off preliminary expenses.

The correct answer is Writing off capital losses.

16. Net Assets minus Capital Reserve is:

- Purchase consideration

- Goodwill

- Total assets

- Liquid assets

The correct answer is Liquid assets

17. Kalki and Kumud were partners sharing profits and losses in the

ratio of 5:3. On 1st April,2021 they admitted Kaushtubh as a new

partner and new ratio was decided as 3:2:1.

Goodwill of the firm was valued as ₹3,60,000. Kaushtubh couldn’t

bring any amount for goodwill. Amount of goodwill share to be

credited to Kalki and Kumud Account’s will be: -

- ₹ 37,500 and ₹22,500 respectively

- ₹ 30,000 and ₹30,000 respectively

- ₹ 36,000 and ₹24,000 respectively

- ₹ 45,000 and ₹15,000 respectively

The correct answer is ₹ 45,000 and ₹15,000 respectively

18. Sarvesh, Sriniketan and Srinivas are partners in the ratio of 5:3: 2. If Sriniketan’s share of profit at the end of the year amounted to ₹1,50,000, what will be Sarvesh’s share of profits?

- ₹5,00,000.

- ₹1,50,000.

- ₹3,00,000.

- ₹2,50,000.

The correct answer is ₹2,50,000.

Part – I

Section – B

Instructions:

From question number 19 to 36, attempt any 15 questions.

Angle and Circle ware partners in a firm. Their Balance Sheet

showed Furniture at ₹2,00,000; Stock at ₹1,40,000; Debtors at

₹1,62,000 and Creditors at ₹60,000. Square was admitted and new

profit-sharing ratio was agreed at 2:3:5. Stock was revalued at

₹1,00,000, Creditors of ₹15,000 are not likely to be claimed,

Debtors for ₹2,000 have become irrecoverable and Provision for

doubtful debts to be provided @ 10%.

Angle’s share in loss on revaluation amounted to ₹30,000. Revalued

value of Furniture will be:

- ₹2,17,000

- ₹1,03,000

- ₹3,03,000

- ₹1,83,000

The correct answer is ₹1,83,000

20. Asha and Nisha are partner’s sharing profits in the ratio of 2:1.

Kashish was admitted for 1/4 share of which 1/8 was gifted by

Asha. The remaining was contributed by Nisha.

Goodwill of the firm is valued at ₹ 40,000. How much amount for

goodwill will be credited to Nisha’s Capital account?

- ₹2,500.

- ₹5,000.

- ₹20,000.

- ₹ 40,000.

The correct answer is ₹5,000.

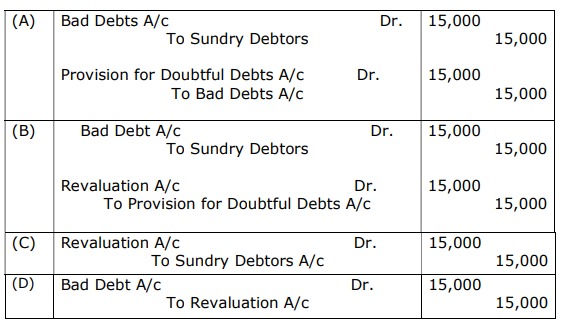

21. At the time of admission of new partner Vasu, Old partners Paresh and Prabhav had debtors of ₹6,20,000 and a provision for doubtful debts of ₹20,000 in their books. As per terms of admission, assets were revalued, and it was found that debtors worth ₹15,000 had turned bad and hence should be written off. Which journal entry reflects the correct accounting treatment of the above situation.

The correct answer is A

22. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R)

Assertion (A): Transfer to reserves is shown in P & L Appropriation A/c.

Reason (R): Reserves are charge against the profits.

In the context of the above statements, which one of the following is correct?

Codes:

- (A) is correct, but (R) is wrong.

- Both (A) and (R) are correct.

- (A) is wrong, but (R) is correct.

- Both (A) and (R) are wrong.

The correct answer is (A) is correct, but (R) is wrong.

23. Anubhav, Shagun and Pulkit are partners in a firm sharing profits

and losses in the ratio of 2:2:1. On 1st April 2021, they decided to

change their profit-sharing ratio to 5:3:2. On that date, debit

balance of Profit & Loss A/c ₹30,000 appeared in the balance sheet

and partners decided to pass an adjusting entry for it.

Which of the undermentioned options reflect correct treatment for

the above treatment?

- Shagun's capital account will be debited by ₹3,000 and Anubhav’s capital account credited by ₹3,000

- Pulkit's capital account will be credited by ₹3,000 and Shagun's capital account will be credited by ₹3,000

- Shagun's capital account will be debited by ₹30,000 and Anubhav’s capital account credited by ₹30,000

- Shagun's capital account will be debited by ₹3,000 and Anubhav’s and Pulkit’s capital account credited by ₹2,000 and ₹1,000 respectively.

The correct answer is Shagun's capital account will be debited by ₹3,000 and Anubhav’s capital account credited by ₹3,000.

24. A, B and C are partners, their partnership deed provides for interest on drawings at 8% per annum. B withdrew a fixed amount in the middle of every month and his interest on drawings amounted to ₹4,800 at the end of the year. What was the amount of his monthly drawings?

- ₹10,000.

- ₹5,000.

- ₹1,20,000.

- ₹48,000.

The correct answer is ₹10,000.

25. Abhay and Baldwin are partners sharing profit in the ratio 3:1. On 31st March 2021, firm’s net profit is ₹1,25,000. The partnership deed provided interest on capital to Abhay and Baldwin ₹15,000 & ₹10,000 respectively and Interest on drawings for the year amounted to ₹6000 from Abhay and ₹4000 from Baldwin. Abhay is also entitled to commission @10% on net divisible profits. Calculate profit to be transferred to Partners Capital A/c’s.

- ₹1,00,000

- ₹1,10,000

- ₹1,07,000

- ₹90,000

The correct answer is ₹1,00,000.

SECTION B

This section consists of 24 multiple choice questions with overall choice to attempt any 20 questions. In case more than desirable number of questions are attempted, ONLY first 20 will be considered for evaluation.

26. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Revaluation A/c is prepared at the time of Admission of a partner.

Reason (R): It is required to adjust the values of assets and liabilities at the time of admission of a partner, so that the true financial position of the firm is reflected.

In the context of the above two statements, which of the following is correct?

Codes:

- Both (A) and (R) are correct and (R) is the correct reason of (A).

- Both (A) and (R) are correct but (R) is not the correct reason of (A).

- Only (R) is correct.

- Both (A) and (R) are wrong.

The correct answer is Both (A) and (R) are correct and (R) is the correct reason of (A).

27. Apaar Ltd forfeited 4,000 shares of ₹20 each, fully called up, on which only application money of ₹6 has been paid. Out of these 2,000 shares were reissued and ₹8,000 has been transferred to capital reserve. Calculate the rate at which these shares were reissued.

- ₹20 Per share

- ₹18 Per share

- ₹22 Per share

- ₹8 Per share

The correct answer is ₹18 Per share.

28. Which of the following statement is/are true?

- Authorized Capital < Issued Capital

- Authorized Capital ≥ Issued Capital

- Subscribed Capital ≤ Issued Capital

- Subscribed Capital > Issued Capital

- (i) only

- (i) and (iv) Both

- (ii) and (iii) Both

- (ii) only

The correct answer is (ii) and (iii) Both.

29. Mickey, Tom and Jerry were partners in the ratio of 5:3:2. On 31st March 2021, their books reflected a net profit of ₹2,10,000. As per the terms of the partnership deed they were entitled for interest on capital which amounted to ₹80,000, ₹60,000 and ₹40,000 respectively. Besides this a salary of ₹60,000 each was payable to Mickey and Tom.

Calculate the ratio in which the profits would be appropriated.

- 1:1:1

- 5:3:2

- 7:6:2

- 4:3:2

The correct answer is 7:6:2

30. Mohit had been allotted for 600 shares by a Govinda Ltd on pro rata basis which had issued two shares for every three applied. He had paid application money of ₹3 per share and could not pay allotment money of ₹5 per share. First and final call of ₹2 per share was not yet made by the company. His shares were forfeited. the following entry will be passed: Equity Share Capital A/c Dr ₹X To share Forfeited A/c ₹Y To Equity Share Allotment A/c ₹Z Here X, Y and Z are:

- ₹ 6,000; ₹2,700; ₹3,000 respectively.

- ₹ 9,000; ₹2,700; ₹4,500 respectively.

- ₹ 4,800; ₹2,700; ₹2,100 respectively.

- ₹ 7,200; ₹2,700; ₹4,500 respectively.

The correct answer is ₹ 4,800; ₹2,700; ₹2,100 respectively.

31. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): In case of shares issued on Pro–rata basis, excess money received at the time of application can be utilised till allotment only.

Reason (R): Company has to pay interest on calls in advance @12% p.a. for amount adjusted towards calls (if any). In the context of the above two statements, which of the following is correct?

Codes:

- Both (A) and (R) are true, but (R) is not the explanation of working capital management.

- Both(A) and (R) are true and (R) is a correct explanation of (A).

- Both (A) and (R) are false.

- (A) is false, but (R) is true.

The correct answer is (A) is false, but (R) is true.

32. Ajay and Vinod are partners in the ratio of 3:2. Their fixed Capital were ₹3,00,000 and ₹4,00,000 respectively. After the close of accounts for the year it was observed that the Interest on Capital which was agreed to be provided at 5% pa was erroneously provided at 10%p.a. By what amount will Ajay’s account be affected if partners decide to pass an adjustment entry for the same?

- Ajay’s Current A/c will be Debited by ₹15,000.

- Ajay’s Current A/c will be Credited by ₹6,000.

- Ajay’s Current A/c will be Credited by ₹35,000.

- Ajay’s Current A/c will be Debited by ₹20,000.

The correct answer is Ajay’s Current A/c will be Credited by ₹6,000.

33. Vishnu Ltd. forfeited 20 shares of ₹10 each, ₹8 called up, on which John had paid application and allotment money of ₹5 per share, of these, 15 shares were reissued to Parker as fully paid up for ₹6 per share. What is the balance in the share Forfeiture Account after the relevant amount has been transferred to Capital Reserve Account?

- ₹0

- ₹5

- ₹25

- ₹100

The correct answer is ₹25

34. Newfound Ltd took over business of Old land ltd and paid for it by issue of 30,000, Equity Shares of ₹100 each at a par along with 6% Preference Shares of ₹1,00,00,000 at a premium of 5% and a cheque of ₹8,00,000. What was the total agreed purchase consideration payable to Old Land ltd.

- ₹1,05,00,000.

- ₹1,43,00,000.

- ₹1,40,00,000.

- ₹1,35,00,000.

The correct answer is ₹1,43,00,000.

35. A and B are partners in the ratio of 3:2. C is admitted as a partner and he takes ¼th of his share from A. B gives 3/16 from his share to C. What is the share of C?

- 1/4

- 1/16

- 1/6

- 1/16

The correct answer is 1/4

36. Krishan Ltd has Issued Capital of 20, 00,000 Equity shares of ₹10 each. Till Date ₹8 per share have been called up and the entire amount received except calls of ₹4 per share on 800 shares and ₹3 per share from another holder who held 500 shares. What will be amount appearing as ‘Subscribed but not fully paid capital’ in the balance sheet of the company?

- ₹ 2,00,00,000

- ₹ 1,95,99,000

- ₹ 1,59,95,300

- ₹ 1,99,95,300

The correct answer is 1,59,95,300

Part – I

Section – C

Instructions:

From question number 37 to 41, attempt any 4 questions.

Question no.’s 37 and 38 are based on the hypothetical situation given below.

Bright Star Limited is engaged in manufacture of high-end medical equipment. Considering the prospects of high growth in this segment the company has decided to expand and for this purpose additional investment of ₹50,00,00,000 is required. Directors have decided that 20% of this requirement would be financed by raising long term debts and balance by issue of Equity shares.

As per memorandum of association of the company the face value of Equity shares is ₹100 each. Also, considering the market standing of the company these shares would be issued at a premium of 25%. Directors decided to issue sufficient shares to collect the desired amount (including premium).

The prospectus was issued to public, and the issue was oversubscribed by 2,00,000 shares which were issued letters of regret. Answer the below mentioned questions considering that the entire amount was payable on application.

37. What is the total amount collected on application?

- ₹42,50,00,000

- ₹40,00,00,000

- ₹32,00,00,000

- None of the above

The correct answer is ₹42,50,00,000

38. How many Equity shares were offered for issue by Bright Star Ltd?

- 40,00,000 shares.

- 50,00,000 shares.

- 35,00,000 shares.

- 32,00,000 shares.

The correct answer is 32,00,000 shares.

Question no.’s 39, 40 and 41 are based on the hypothetical situation given below.

On 1st September 2020, twenty students of Modern College started their Partnership Firm in the name of “Be Safe” for selling sanitisers on digital mode. Since they were good friends of each other, they were not having any explicit agreement in place. All of them have agreed to invest ₹15,000/- each as capital. The books were closed on 31st March 2021, on which date the following information was provided by the firm:

| PARTICULARS | AMOUNT (₹) |

|---|---|

| Sale of Sanitisers | 1,20,000 |

| Cost of goods sold | 50,000 |

| Total Remuneration to partners | 2,000 per month |

| Rent to a partner | 1,000 per month |

| Manager's Commission | 5,000 |

| Closing Stock as on March 31,2021 | 9,000 |

| 6% Fixed Deposit (made on 31.3.2021) | 20,000 |

39. Calculate the amount of profits to be transferred to Profit and Loss Appropriation Account. -

- Profit ₹58,000

- Profit ₹44,000

- Profit ₹59,200

- Profit ₹58,700

The correct answer is Profit ₹58,000.

40. On 31st March 2021, Remuneration to Partners will be provided to the partners of “Be Safe” but only out of:

- Profits for the accounting year

- Reserves

- Accumulated Profits

- Goodwill

The correct answer is Profits for the accounting year

41. AOn 01st December 2020 one of the partners of the firm introduced additional capital of ₹30,000 and also advanced a loan of ₹40,000 to the firm. Calculate the amount of interest that Partner will receive for the current accounting period-

- ₹4,200

- ₹1,400

- ₹ 1575

- ₹ 800

The correct answer is ₹ 800

Part – II

Section – A

Instructions:

From question number 42 to 48, attempt any 5 questions.

42. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): The focus of calculation of working capital revolves around managing the operating cycle of the business.

Reason (R): It is because the concept of operating cycle is required to ascertain the liquidity of assets and urgency of payments to liabilities.

In the context of the above two statements, which of the following is correct?

Codes:

- Both (A) and (R) are true, but (R) is not the explanation of working capital management.

- Both(A) and (R) are true and (R) is a correct explanation of (A).

- Both (A) and (R) are false.

- (A) is false, but (R) is true.

The correct answer is Both(A) and (R) are true and (R) is a correct explanation of (A).

43. Which of the following are included in traditional classification of ratios?

- Liquidity Ratios.

- Statement of Profit and loss Ratios.

- Balance Sheet Ratios.

- Profitability Ratios.

- Composite Ratios.

- Solvency Ratios.

- (ii), (iii) and (v)

- (i), (iv) and (vi)

- (i), (ii) and (vi)

- All (i), (ii), (iii), (iv), (v), (vi)

The correct answer is (ii), (iii) and (v).

44. The following groups of ratios primarily measure risk:

- solvency, activity, and profitability

- liquidity, efficiency, and solvency

- liquidity, activity, and profitability

- liquidity, solvency, and profitability

The correct answer is liquidity, solvency, and profitability

45. Which one of the following is correct?

- A ratio is an arithmetical relationship of one number to another number.

- Liquid ratio is also known as acid test ratio.

- Ideally accepted current ratio is 1: 1.

- Debt equity ratio is the relationship between outsider’s funds and shareholders’ funds.

In the context of the above two statements, which of the following options is correct?

- All (i), (ii), (iii) and (iv) are correct.

- Only (i), (ii) and (iv) are correct.

- Only (ii), (iii) and (iv) are correct.

- Only (ii) and (iv) are correct.

The correct answer is Only (i), (ii) and (iv) are correct.

46. Which of the following are the tools of Vertical Analysis?

- Ratio Analysis.

- Comparative Statements.

- Common Size Statements.

- Only (iii)

- Both (i) and (iii)

- Both (i) and (ii)

- Only (i)

The correct answer is Both (i) and (iii)

47. Match the items given in Column I with the headings/subheadings (Balance sheet) as defined in Schedule III of Companies Act 2013.

| Column I | Column II |

|---|---|

| (I) Loose Tools | (a) Intangible fixed assets |

| (Ii) Patents | (b)Other current assets |

| (III) Prepaid insurance | (c) Long term Borrowings |

| (IV) Debentures | (d) Inventories |

| (V) Machinery | (e) Tangible Fixed assets |

Choose the correct option:

- (I)-(a), (II)-(b), (III)- (d), (IV)- (c), (V)-(e)

- (I)-(d), (II)- (a), (III)-(b), (IV)- (c), (V)-(e)

- (I)-(d), (II)- (a), (III)-(b), (IV)-(e), (V)-(c)

- (I)- (e), (II)- (d), (III)- (a), (IV)-(b), (V)-(b)

The correct answer is (I)-(d), (II)- (a), (III)-(b), (IV)- (c), (V)-(e)

48. Which ratio indicates the proportion of assets financed out of shareholders’ funds?

- Debt equity ratio.

- Fixed assets turnover ratio.

- Proprietary ratio.

- Total assets to debt ratio.

The correct answer is Proprietary ratio.

Part – II

Section – B

Instructions:

From question number 49 to 55, attempt any 6 questions.

49. If Total sales is ₹2,50,000 and credit sales is 25% of Cash sales. The amount of credit sales is:

- ₹50,000

- ₹2,50,000

- ₹16,000

- ₹3,00,000

The correct answer is ₹50,000

50. What will be the amount of gross profit of a firm if its average inventory is ₹80,000, Inventory turnover ratio is 6 times, and the Selling price is 25% above cost?

- ₹1,20,000.

- ₹1,60,000.

- ₹2,00,000.

- None of the above.

The correct answer is ₹1,20,000.

51. Which of the following statements are false?

- When all the comparative figures in a balance sheet are stated as percentage of the total, it is termed as horizontal analysis.

- When financial statements of several years are analysed, it is termed as vertical analysis.

- Vertical Analysis is also termed as time series analysis. Choose from the following options:

- Both (a) and (b)

- Both (a) and (c)

- Both (b) and (c)

- All three (a), (b), (c)

The correct answer is All three (a), (b), (c)

52. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Increasing the value of closing inventory increases profit.

Reason (R): Increasing the value of closing inventory reduces cost of goods sold.

In the context of the above two statements, which of the following is correct?

Codes:

- Both (A) and (R) are correct and (R) is the correct reason of (A).

- Both (A) and (R) are correct but (R) is not the correct reason of (A).

- Only (R) is correct.

- Both (A) and (R) are wrong.

The correct answer is Both (A) and (R) are correct and (R) is the correct reason of (A).

53. Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): A high operating ratio indicates a favourable position.

Reasoning (R): A high operating ratio leaves a high margin to meet non-operating expenses.

In the context of the above two statements, which of the following is correct?

Code:

- (A) and (R) both are correct and (R) correctly explains (A).

- Both (A) and (R) are correct but (R) does not explain (A).

- Both (A) and (R) are incorrect.

- ) (A) is correct but (R) is incorrect.

The correct answer is Both (A) and (R) are incorrect.

54. Current ratio of Adaar Ltd. is 2.5:1. Accountant wants to maintain it at 2:1. Following options are available.

- He can repay Bills Payable

- He can purchase goods on credit

- He can take short term loan

Choose the correct option.

- Only (i) is correct

- Only (ii) is correct

- Only (i) and (iii) are correct

- Only (ii) and (iii) are correct

The correct answer is the current is Only (ii) and (iii) are correct

55. A company has an operating cycle of eight months. It has accounts receivables amounting to ₹1,00,000 out of which ₹60,000 have a maturity period of 11 months. How would this information be presented in the balance sheet?

- ₹40000 as current assets and ₹60,000 as non-current assets.

- ₹60,000 as current assets and ₹40,000 as non-current assets.

- ₹1,00,000 as non-current assets.

- ₹1,00,000 as Current assets.

The correct answer is ₹1,00,000 as Current assets.

Part – III

Section – A

Instructions:

From question number 56 to 62, attempt any 5 questions.

56. Which key combination collapses the ribbon?

- [Ctrl]+[F1]

- [Ctrl]+[F3]

- [Ctrl]+[F5]

- [Ctrl]+[F7]

The correct answer is [Ctrl]+[F1]

57. The CAS should be-

- Simple and integrated, transparent, accurate, scalability, reliability.

- Complex, Accurate, Transparent, faster to work.

- Able to transform the manual accounting system to computerised accounting system.

- None of the above.

The correct answer is Simple and integrated, transparent, accurate, scalability, reliability.

58. The components of Computerised Accounting System are:

- Data, Report, Ledger, Hardware, Software.

- Data, People, Procedure, Hardware, Software.

- People, Procedure, Ledger, Data, Chart of Accounts.

- Data, Coding, Procedure, Rules, Output.

The correct answer is Data, People, Procedure, Hardware, Software.

59. Where are amounts owed by customers for credit purchases found?

- accounts receivable journal

- general ledger

- sales journal

- accounts receivable subsidiary ledger

The correct answer is accounts receivable subsidiary ledger

60. What is the activity sequence of the basic information processing model?

- Organise data, process data, and collect data

- Collect data, organise and process data, and communicate information

- Process data, organise data, and collect data

- Organise data, collect data, and communicate information

The correct answer is Collect data, organise and process data, and communicate information

61. Codification of Accounts required for the purpose of:

- Hierarchical relationship between groups and components

- Data processing faster and preparing of final accounts

- Keeping data and information secured

- None of the above.

The correct answer is Hierarchical relationship between groups and components

62. Which mathematical operator is represented by an asterisk (*)?

- Exponentiation

- Addition

- Subtraction

- Multiplication

The correct answer is Multiplication

Part – III

Section – B

Instructions:

From question number 63 to 69, attempt any 6 questions.

63. What category of functions is used in this formula: =PMT (C10/12, C8, C9,1)

- Logical

- Financial

- Payment

- Statistical

The correct answer is Financial

64. When Extend Selection is active, what is the keyboard shortcut for selecting all data up to and including the last row?

- [Ctrl]+[Down-arrow]

- [Ctrl]+[Home]

- [Ctrl]+[Shift]

- [Ctrl]+ [Up Arrow]

The correct answer is [Ctrl]+[Shift]

65. Which formulae would result in TRUE if C4 is less than 10 and D4 is less than 100?

- =AND(C4>10, D4>10)

- =AND(C4>10, C4<100).

- =AND(C4>10, D4<10).

- =AND (C4<10, D4,100)

The correct answer is =AND (C4<10, D4,100)

66. Where is the address of the active cell displayed?

- Row heading

- Status bar

- Name Box

- Formula bar

The correct answer is Name Box

67. Which of the following arguments in a financial function represents the total number of payments?

- FV

- PV

- Nper

- Rate

The correct answer is Nper

68. Which function results can be displayed in Auto Calculate?

- SUM and AVERAGE

- MAX and LOOK

- LABEL and AVERAGE

- MIN and BLANK

The correct answer is SUM and AVERAGE

69. When navigating in a workbook, which command is used to move to the beginning of the current row?

- [Ctrl]+[Home]

- [Page Up]

- [Home]

- [Ctrl]+[Backspace]

The correct answer is [Home]

Last Updated on : December 13, 2021